September 5, 2018

As GM Goes, So Goes Healthcare: Dynamics of Demand-Driven Reform

“For years I [have] thought what was good for our country was good for General Motors, and vice versa.” Charles E. Wilson

Last month, General Motors signed a 5-year agreement with Henry Ford Health System to provide comprehensive healthcare services for GM’s salaried employees in Southeast Michigan. This is a landmark transaction that moves GM away from pure fee-for-service (FFS) payment while holding Henry Ford accountable for care delivery cost, quality, outcomes and service levels.

Last month, General Motors signed a 5-year agreement with Henry Ford Health System to provide comprehensive healthcare services for GM’s salaried employees in Southeast Michigan. This is a landmark transaction that moves GM away from pure fee-for-service (FFS) payment while holding Henry Ford accountable for care delivery cost, quality, outcomes and service levels.

The GM-Henry Ford agreement will be Michigan’s first direct care contract. It reflects changing market dynamics and a maturing relationship between large self-insured employers and large integrated healthcare systems.

Nationwide, only 3% of self-insured companies contract directly with providers.[1] Expect that percentage to grow as large employers demand a higher return for their healthcare spending. GM is leading the way. The future belongs to value-based care design and delivery.

What’s Good for GM…

After World War II the United States dominated the world economy. With 6% of the world’s population, America’s manufacturing-based economy accounted for half of global GDP. GM was America’s largest corporation, synonymous with the country’s growing industrial base, confidence and political power.

Charles E. Wilson, “Engine Charlie,” became GM’s president in 1941 and oversaw the company’s massive defense production effort. In 1946 President Truman awarded Wilson a Medal of Merit, the nation’s highest civilian decoration, in recognition of his contribution to the war effort.

In January 1953, just-elected President Dwight Eisenhower nominated Charles E. Wilson to be Secretary of Defense. Wilson was reluctant to sell his GM stock, which raised conflict-of-interest concerns during his Senate confirmation hearings. When asked about this perceived conflict, Wilson acknowledged its existence but doubted a true conflict could ever occur. He added,

In January 1953, just-elected President Dwight Eisenhower nominated Charles E. Wilson to be Secretary of Defense. Wilson was reluctant to sell his GM stock, which raised conflict-of-interest concerns during his Senate confirmation hearings. When asked about this perceived conflict, Wilson acknowledged its existence but doubted a true conflict could ever occur. He added,

“For years I [have] thought what was good for our country was good for General Motors, and vice versa.”

Wilson’s statement condensed into “What’s good for General Motors is good for the country” and went viral. That was a long time ago. GM’s share of the U.S. auto market has declined to 17% after peaking at 50% in the 1960s. The company filed for bankruptcy in 2009, sold assets, accepted government support and emerged as a smaller, leaner auto manufacturer.

Since GM’s heyday, healthcare has replaced steel as the most expensive cost component in car manufacturing. Controlling healthcare has become a national priority. For this reason, what’s good for GM in healthcare is good for the country.

GM’s agreement with Henry Ford Health System improves benefit design, lowers employee premiums and reduces total care costs while achieving superior health outcomes. GM’s hope is to expand direct-provider contracting in Michigan and introduce it into new markets where GM has large numbers of employees.

Addiction to Commercial Premiums

Among the many ironies embedded within American healthcare is that American corporations massively subsidize healthcare provision (through high-cost commercial insurance policies) and do not demand greater value for their healthcare purchases.

Demand-driven change generates superhero results. Markets respond to customer desires. That doesn’t happen enough in healthcare.

My greatest frustration with American healthcare is that self-insured corporations haven’t used their massive purchasing power to demand better healthcare provision. Exactly the opposite has happened. Health systems have skewed service provision and facility distribution toward higher-paying, commercially-insured patients.

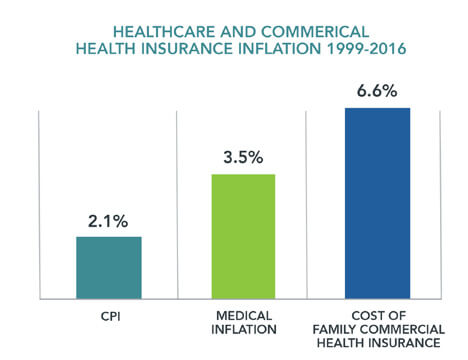

This chart depicts annualized inflation rates between 1999 and 2016 for the general economy, medical spending and commercial family insurance policies.

Sources: Henry J. Kaiser Family Foundation; Bureau of Labor Statistics.

The Henry J. Kaiser Family Foundation began tracking the cost of health insurance policies in 1999. Since that time, the cost of a commercial family health insurance policy has risen at a rate more than three times higher than general inflation and almost double that of medical inflation.

As a consequence, healthcare providers have become increasingly dependent upon commercial insurance (funded primarily by self-insured employers) to offset losses generated by treating government-insured and self-paying patients. As their costs have risen, employers have shifted more of their health insurance expense to employees through higher premiums, deductibles and copays.

Regular Americans are straining under this increasing healthcare cost burden. During this period, wages have stagnated for working families in part because an increasing percentage of their total compensation must fund skyrocketing health insurance premiums and healthcare costs. For this reason, Americans now worry more about healthcare costs than access.

Here’s the Deal

The GM-Henry Ford agreement creates an attractively priced “narrow network” health insurance option called “ConnectedCare” for GM’s non-unionized employees. ConnectedCare’s annual premiums will be $300-$620 less for individuals and $860-$1980 less for families. There will be significantly higher copays for out-of-network care.

For its part, Henry Ford has expanded its delivery network to improve access and entered into contractual agreements to address coverage gaps in pediatrics and behavioral health. Predetermined procedure costs and coverage caps will reduce Henry Ford’s administrative burden by eliminating preauthorization requirements from a third-party administrator.

Blue Cross of Michigan will administer the contract, process claims, and assess whether Henry Ford meets predetermined cost thresholds and quality metrics for customer service, preventive care and chronic disease management. GM and Henry Ford will share cost savings equally.

The parties expect half of GM’s 24,000 salaried employees in Southeastern Michigan will become ConnectedCare enrollees over time. GM anticipates saving 10% in total health costs over the 5-year contract term.

The parties expect half of GM’s 24,000 salaried employees in Southeastern Michigan will become ConnectedCare enrollees over time. GM anticipates saving 10% in total health costs over the 5-year contract term.

Direct contracts carry substantial financial risk for health systems. Henry Ford will lose money on the contract if it cannot control total health expenditures while meeting established quality metrics. Providence St. Joseph Health cancelled its narrow network agreement for Boeing’s Seattle-based employees last year after sustaining substantial financial losses.

Narrow delivery networks are not new. Providers offer lower care costs and better care coordination in exchange for higher, more reliable patient volume. However direct contracting through narrow delivery networks is not a panacea. Narrow networks have the following implicit flaws that diminish their effectiveness:

- Pressure to deliver patients in-network care even when it yields suboptimal results.

- Direct contracts still apply fee-for-service payment methodologies to determine costs and allocate savings.

- Distribution of savings occurs retrospectively and requires a time-consuming and costly reconciliation process by third-party administrators.

- Providers achieve savings primarily by reducing care costs for medically complex individuals. While beneficial, this reduces focus on preventive care.

The Holy Grail

America will not transform healthcare delivery until it changes the way it pays for healthcare services. FFS payment is the principal impediment to systematic healthcare reform. Direct contracting begins the journey away from FFS payment. The final destination is full-risk contracting.

FFS payment is healthcare’s kryptonite. It fragments care delivery and creates perverse economic incentives while heaping administrative burdens on providers. It thwarts caregiver-patient relationships and impedes care quality. It reduces family incomes, diminishes communities and lowers economic productivity.

FFS payment is deeply imbedded within the American healthcare system. Incremental approaches to payment and delivery transformation wither. Real transformation requires radical payment reform.

Full-risk contracting achieves radical payment reform by making health companies fully accountable for care outcomes, quality and costs. It comes in the following two basic forms:

- Predetermined “bundled” payments for episodic care. These generally carry 90-day performance guarantees.

- Fixed monthly payments to cover the health risk for distinct populations. These programs, such as Medicare Advantage (MA), adjust the monthly premium for each individual’s predicted health risk.

With revenues largely fixed, health companies participating in full-risk contracting must deliver necessary care within budgetary constraints or lose money. Since many full-risk programs incorporate customer choice, successful health companies also must deliver a great consumer experience to achieve long-term sustainability.

The challenge is in scaling full-risk contracting arrangements where they garner enough market concentration to displace FFS medicine. Healthcare transformation cannot occur until FFS payment dies, and FFS payment will not die until healthcare’s buyers (employers, governments, individuals) employ full-risk contracting to purchase healthcare services.

Consequently, GM and Henry Ford still have significant work ahead of them. Implementing their narrow network contract will not be easy. They will have to change healthcare consumption behaviors and healthcare practice patterns to achieve savings targets and quality metrics.

Real care transformation will come as the parties transcend beyond accountable care mechanics by delivering the right care at the right time at the right price. For this transformation, healthcare’s secret weapon (and healthcare’s most disruptive innovation) is full-risk contracting. Full-risk contracting promotes effective and efficient healthcare delivery.

GM is tackling healthcare to make the company more competitive in the automotive business. Like healthcare, transportation is disrupting as consumers demand low cost, convenient services on their terms. This is why GM bought an ownership stake in Lyft, the mobile transit company. To survive, GM must become a “mobility” company as well as an automobile manufacturing and finance company.

As healthcare decentralizes, there’s an opportunity to combine mobility capabilities with efficient healthcare delivery to improve care outcomes, lower costs and improve customer services. Imagine if GM and Henry Ford Health System announced that type of partnership. Healthcare would never be the same.