August 2, 2022

“Amazoning” One Medical: Unleashing Primary Care Magic at Scale

Healthcare’s ecosystem is atwitter (literally) regarding Amazon’s $3.9 billion acquisition of One Medical. On last week’s 4sight Friday Roundup podcast, my partner Julie Murchison said she can’t stop thinking about the deal. She then made several surprising and insightful observations. We also discussed Apple’s new strategic plan for healthcare. Listen here.

Anything Amazon touches arouses tremendous interest. An avalanche of deal summaries and commentaries have emerged in the wake of the July 21st announcement. The blogosphere has zeroed in on how Amazon will incorporate One Medical into its healthcare platform, the 75% purchase price premium it paid for the asset, and Amazon’s potential to disrupt the healthcare industry. Opinions are split on the last question.

My two favorite analyses were Scott Galloway’s “Prime Health” commentary and the Health Tech Nerds’ in-depth assessment contained in their July 24th “Weekly Health Tech Reads” distribution. The Health Tech Nerds (HTN) are Kevin O’Leary and Ryan Russell. Their full commentary sits behind a pay wall.

Scott thinks Amazon’s acquisition of One Medical is a gamechanger,

The U.S. healthcare industry is a wounded 7-ton seal, drifting aimlessly, bleeding into the sea. Predators are circling. The blood in the water is unearned margin: price increases, relative to inflation, without a concomitant improvement in quality. Amazon is the lurking megalodon, its 11-foot jaws and 7-inch teeth the largest in history. With the acquisition of One Medical, Amazon is no longer circling … but attacking.

Kevin and Ryan’s bottom line is less colorful and more skeptical,

It seems fairly obvious to say this a signal that Amazon is in healthcare to win and will be here to stay – a $3.9 billion acquisition would be a colossal failure if that weren’t the case. But our best guess is that 5-10 years from now we’ll look back on One Medical as a quaint notion about the concept of changing care delivery in this country for the better, but Amazon will be yet another giant corporation struggling to provide high quality care consistently.

My own opinion aligns with Scott’s. One Medical has untangled the Gordian Knot of healthcare consumerism through its unique membership and service model. Applying Amazon’s capital, capabilities and capacity to scale will enhance the platform’s capacity to do the following:

- Lower member acquisition costs (4 million Americans have Prime memberships)

- Expand quickly into new markets (One Medical clinics in Whole Foods stores?)

- Integrate desired technologies (virtual care, pharmacy services, voice-based connectivity) at scale

By incorporating One Medical into its overall healthcare platform, Amazon is positioning to become a dominant primary care provider with a full range of in-person and digital offerings. More importantly, it could become a powerful channel for determining where and on what terms One Medical members receive specialty care services. In this sense, One Medical will have as much or more influence on Amazon’s healthcare operations as Amazon will have One Medical’s platform growth.

Amir’s Answer

I have known and admired One Medical’s CEO Amir Rubin since he was a young CEO at Stanford Health Care. Shortly after he joined One Medical from Optum in August 2017, we had lunch at Chipotle in downtown San Francisco. Amir was wearing blue jeans and a black turtleneck sweater. It was the first time I’d ever seen him not wearing a suit. He, of course, was sporting his signature black-rimmed glasses.

During our lunch, I observed that there were many venture-funded companies serving Medicare Advantage (MA) and dual-eligible Medicare/Medicaid enrollees. At the time, only One Medical provided enhanced primary care services at scale nationally to individuals with commercial health insurance. I asked him why this was. Amir’s answer was insightful, nuanced and deeply reasoned.

MA and dual-eligible health insurance programs are government funded and have pre-determined capitated payments. Payers and providers running these care management programs understand what’s required to enroll members, set the monthly payment rates, report outcomes and optimize financial performance.

By contrast, commercial health insurers negotiate payment rates and terms directly with providers for their insured members. Those rates vary widely. Most primary care providers align with hospitals/health systems and become the principal referral sources for diagnostics and specialty care. Within these networks, referrals create an efficient way to shorten primary care visits and optimize total revenues. Care outcomes and customer services are secondary concerns.

In Amir’s opinion, building a consumer-oriented, outcomes-driven primary care offering for commercially insured individuals is exceptionally hard. It requires operating independently and simultaneously satisfying market demands for five separate stakeholders: 1. consumers; 2. employed clinicians; 3. employers; 4. commercial insurers; and 5. providers (physician groups and hospitals/health systems). One Medical’s ability to serve these diverse stakeholders successfully is the “secret sauce” that has turbocharged their organic growth:

- Consumers: By far, consumers are One Medical’s most important stakeholder. Delighting consumers fuels membership growth and burnishes One Medical’s brand. The company projects 800,000 members by the end 2022, double its December 2019 figure. Julie Murchison and I are both One Medical members and often discuss their service model: attractive, efficient and convenient offices; appointments that are easy to schedule; immediate service; friendly clinicians who don’t require intermediaries; timely follow-up; no ancillary services so no unnecessary tests; 24/7 access through a user-friendly app; robust patient education; and more.The numbers speak for themselves: 90+ % Net Promoter Scores; 2-minute average lobby wait times; 3 times digital to office interactions. As Julie notes, “One Medical’s care may not be better, but it sure feels like it is.”

- Employed Clinicians: Clinicians love working at One Medical. They spend quality time with patients – standard appointments are 45 minutes. The company’s electronic medical record eases rather than complicates treatment regimens, record keeping and follow-up. Clinicians aren’t burdened by excessive administrivia. There aren’t merciless production requirements. Centers work with one another seamlessly to optimize customer service.Using Culture Amp, One Medical doubled participation in employee surveys and used the survey’s feedback to develop targeted employee programs in compensation and recognition, career development and communication. Here’s the bottom line: The One Medical operating model enables its clinicians to fully engage members like Julie and me on our individual health journeys. Everyone is happier.

- Employers: Over 8,000 companies offer One Medical memberships as a benefit to their employees. These enterprise relationships are the principal driver of One Medical’s geometric membership growth. The benefits go both ways: 76% of members surveyed said offering One Medical membership improved their opinion of their employer and 72% rated One Medical membership as one of their most valuable benefits. Not surprisingly, the retention rate for enterprise clients is an astonishing 97%.

- Health Insurance Plans: Insurance plans strive to generate lower premium costs, better care outcomes and happier employees for their self-insured corporate clients. One Medical helps insurers achieve all three of these goals.As described above, enterprise members love the One Medical benefit. On the cost side, One Medical reduces total care costs by 8% and fills 95% of prescriptions with generic drugs. Working with engaged care teams, One Medical members have 41% fewer ER visits and 43% reduction in anxiety levels with care quality above 90% in the Healthcare Effectiveness Data and Information Set (HEDIS) quality scores.

- Providers (Physician Groups and Hospitals/Health Systems): One Medical coordinates access and integrates value-based care with affiliated partners to achieve the superior health care outcomes for its members. As a national primary care provider, One Medical has the scale, reputation and systems necessary to refer their members for timely specialty care with leading providers in local markets.

It’s taken One Medical fifteen years to develop a platform that advances all stakeholder interests systematically and effectively. That platform is now poised for growth. Its major economic challenge has been the high cost of member acquisition as it moves into new markets. That challenge potentially disappears with Amazon ownership.

Overcoming Healthcare’s Artificial Economics

As I discuss in my “Cracks in the Foundation” series for HFM magazine, healthcare incumbents operate within an artificial economic environment that prioritizes revenue generation and profits without commensurate improvement in outcomes and value creation. It is impossible to reform U.S. healthcare without normalizing supply-demand relationships.

In normal markets, intrinsic demand for products and services at given prices drives supply. Healthcare reverses the equation. The supply of healthcare facilities and practitioners propels demand for diagnostic and treatment procedures. More cardiac surgeons generate more cardiac procedures, irrespective of intrinsic market demand. The mechanisms that promote supply-driven demand are fee-for-service (FFS) payment for providers and administrative-services-only (ASO) contracting by health insurers.

Supply-driven demand for healthcare services is not a new phenomenon. In the early 1960s, economist Milton Roemer observed, “Supply may induce its own demand in the presence of third-party payment.” Medicare’s creation in 1965 incorporated the third-party payment mechanisms Roemer feared. Distortive and artificial supply-driven demand governs healthcare economics to the present day and subverts value-driven care delivery by doing the following:

- Compensating “reimbursable care” whether it’s appropriate or not

- Discouraging “appropriate care” when it’s not reimbursable

- Complicating treatment approvals

- Increasing administrative costs

- Distorting the buy-sell relationship between providers and consumers

The results of healthcare’s artificial economics have been catastrophic. The system is inefficient, error-prone, wasteful and self-centered. FFS payment induces supply-driven demand, inflates prices, fragments service provision and complicates billing mechanics. ASO contracting shifts the costs of supply-driven demand to self-insured employers and consumers. Costs continue rise independent of quality and value even as U.S. life expectancy declines.

With Amazon’s acquisition of One Medical, the healthcare ecosystem for the first time has a participant with enough scale, sophistication and market clout to challenge incumbents’ addiction to status quo payment models. With Amazon, demand-driven supply can replace supply-driven demand. “Real” healthcare economics with offerings that deliver better outcomes, lower costs and better customer service can emerge.

Amazon could have acquired large provider organizations like Atrius or Kelsey-Seybold for a fraction of the One Medical purchase price. Those types of acquisitions, however, lack One Medical’s capacity to scale within a well-established national platform. In acquiring One Medical’s operating platform, technologies and capabilities, Amazon intends to steal market share from slow-footed incumbents clinging to FFS payment and ASO contracting.

My first book, Market vs. Medicine: America’s Epic Fight for Better, Affordable Healthcare (published in 2016) had four sections: Assess; Align; Adapt; and Advance. “Adapt,” the third section, explored disruptive innovation. Its subtitle was “Amazoning Healthcare.”

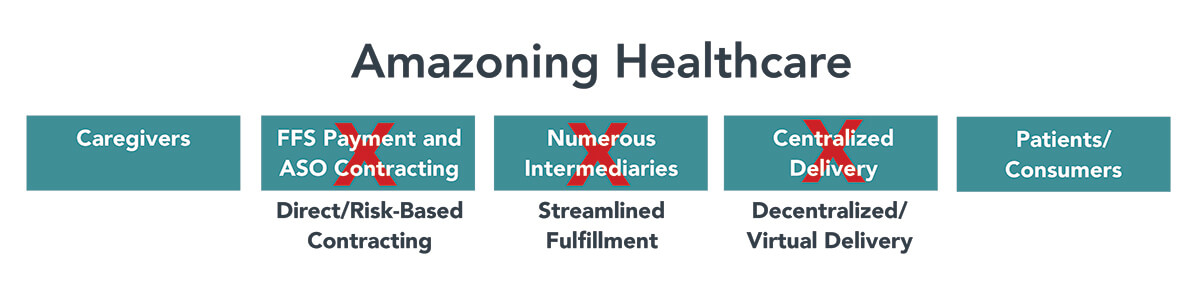

As that subtitle suggests, Amazon now has all the pieces required to normalize healthcare’s supply-demand relationships. Amazon will attack healthcare inefficiency in the same ways it did in the publishing industry – by connecting essential market participants directly with one another.

As that subtitle suggests, Amazon now has all the pieces required to normalize healthcare’s supply-demand relationships. Amazon will attack healthcare inefficiency in the same ways it did in the publishing industry – by connecting essential market participants directly with one another.

The only irreplaceable components in publishing are the authors and the readers. Over time, Amazon’s business practices, scale and technologies diminished and even replaced publishers, distributors and bookstores systematically by attacking these vulnerable supply-chain components.

The same forces that Amazon unleashed to disrupt book publishing, distribution and sales can now attack healthcare. The analogs for “authors and readers” in healthcare are “caregivers and patients.” The vulnerable intermediate supply-chain components include hospitals, insurance companies, brokers, device manufacturers and pharmaceutical suppliers. Here’s how it looks:

Amazoning Healthcare

With the addition of One Medical, Amazon is now well-positioned to exploit and disintermediate inefficient components embedded within America’s high-cost delivery system. They will employ the following strategies to create value and gain customers:

- Market-based payments for treatment

- Direct and full-risk contracting

- Decentralized and virtual care delivery that is accessible and convenient

- Omni-channel apps to coordinate care navigation and communication

- Personalized care services that emphasize health and wellbeing

- Preferred relationships with high-value service providers

In “Amazoned” healthcare, consumers and value-based care win. The market will guide purchasers toward higher-quality, lower-cost providers with great service. No organizations understand this transformative opportunity better than enhanced primary care companies like One Medical and uber-retailers like Amazon.

Market vs. Medicine: Who Wins?

Market vs. Medicine: Who Wins?

There are many unanswered questions regarding how Amazon will integrate One Medical into its healthcare platform. These include whether to use One Medical’s tech stack for its other healthcare services, whether to continue its relationship with Crossover Health which provides clinics for Amazon employees, whether to keep or divest Iora Health (an MA provider acquired by One Medical in 2021), and whether to consolidate AmazonCare into One Medical.

Let’s not mistake the waves for the tide. While these are important strategic decisions for Amazon, they represent refinements on a massive value-based and consumer-oriented play to reinvent healthcare service delivery. Historically, medicine has bent the marketplace to its will. For the first time, the marketplace has a force strong enough to bend medicine to its will.

Almost unbelievably, I finished reading Brad Stone’s Amazon Unbound (published in 2021) the day before Amazon announced its One Medical acquisition. “Amazon Unbound” is Brad’s follow-up book to his best-selling The Everything Store (published in 2013). The second book covers Amazon’s stratospheric growth during the last ten years.

Since 2012, Amazon has launched voice-activated communication with Echo and Alexa; created and become dominant in cloud computing through Amazon Web Services (AWS); reinvented the Amazon marketplace; acquired Whole Foods; built a parcel delivery network that is bigger than FedEx and will soon surpass UPS; moved massively into the entertainment business; and built an advertising juggernaut that generates more revenue than all newspapers combined.

During this ten-year period, Amazon’s market capitalization grew over ten-fold from $120 billion to $1.25 trillion. Its employees numbered under 150,000 in 2012. Today Amazon employs 1.6 million people globally. It’s difficult to fathom or even imagine growth at this scale.

Given its success in launching novel enterprises, reinventing healthcare doesn’t seem beyond Amazon’s capabilities. Neil Lindsay, SVP of Amazon Health Services, said as much in the press release announcing the One Medical acquisition,

We think health care is high on the list of experiences that need reinvention. Booking an appointment, waiting weeks or even months to be seen, taking time off work, driving to a clinic, finding a parking spot, waiting in the waiting room then the exam room for what is too often a rushed few minutes with a doctor, then making another trip to a pharmacy.

We see lots of opportunity to both improve the quality of the experience and give people back valuable time in their days. We love inventing to make what should be easy easier and we want to be one of the companies that helps dramatically improve the healthcare experience over the next several years.

Together with One Medical’s human-centered and technology-powered approach to health care, we believe we can and will help more people get better care, when and how they need it. We look forward to delivering on that long-term mission.

Lindsay doesn’t mention healthcare’s monstrous cost and monumental waste. He doesn’t have to. As Amazon strives to make healthcare better and more consumer-friendly, expect them to attack the industry’s overly centralized delivery, its armies of intermediaries and its antiquated technologies. There are abundant opportunities for improvement.

Amazon Unbound details how Amazon’s “Day One” entrepreneurial mindset has created value for customers across multiple business lines at global scale. It is a long 407-page book that expeditiously explores the components of Amazon’s phenomenal growth as well as Jeff Bezos’ emergence as a global citizen and the world’s wealthiest individual.

For all his book’s deep content and in-depth analysis, Brad Stone only devotes one paragraph to healthcare (on page 405). There will be a very big Amazon healthcare story to chronicle through the coming years. If Brad doesn’t write that book, I will.