March 22, 2022

Healthcare’s Final Frontier: Engaging Consumers

Healthcare is going retail, fast. Care delivery is decentralizing. New interoperability and transparency regulations are making product and service offerings more “shoppable.” Informed and connected consumers are assuming more control over healthcare purchasing decisions. They’re demanding digital-first experiences and solutions.

New business models are flooding into the healthcare marketplace. Consumerism, competition and convenience are reshaping supply-demand relationships. The COVID-19 pandemic has accelerated movement to virtual, home and walk-in care modalities.

Healthcare companies across the service spectrum confront disruptive new market dynamics. Most know they are behind the curve and are striving to catch up. The “unbundling” of care services and payment makes it much easier for their customers to purchase better experiences elsewhere. Traditional client acquisition channels cannot sustain demand.

To conquer this new frontier, payers, providers and manufacturers are seeking out new customers and exploring more enticing ways to deliver services. In short, healthcare is now boldly going where most industries have gone before — into full-fledged consumer engagement.

Consumerism is propelling a monumental paradigm shift in healthcare service provision. Consumer engagement is THE essential ingredient reshaping a complex healthcare ecosystem. Solving real consumer problems is THE strategy required for market success.

For incumbents, consumerism is a double-edged sword. It provides new channels for building brand loyalty and strengthening market positioning. At the same time, it erodes demand from traditional channels as patients redirect care to alternative vendors. Pricing transparency and data interoperability fuel both trends.

As health information becomes interoperable, consumers’ “switching costs” decrease and their choices multiply. Once secure pathways for channeling customers become less reliable. Particularly for routine care, consumers now shop and purchase services outside traditional network providers based on price, convenience and customer experience.

From a brand perspective, incumbents are best positioned within the ecosystem to capitalize upon healthcare’s increasing consumerism. By becoming early movers in digital health technologies, they can create “stickiness” with customers by personalizing their shopping experiences and by making them more convenient and enjoyable.

Sustaining digital loyalty, however, requires deeper levels of consumer engagement. That occurs as maturing digital platforms learn more about individual preferences and then offer tailored information, guidance and service access. This personalized engagement empowers consumers to better manage their health and improve their lives.

Traditional hub-and-spoke business models operating within closed systems are breaking down. They’re losing customers because their fragmented and high-cost service delivery isn’t addressing vital healthcare needs. A new health and consumer-centric paradigm is now emerging to displace the old disease- and hospital-centric paradigm.

Healthcare’s Changing Paradigm Changes Everything

With the publication of The Structure of Scientific Revolutions in 1962, Thomas Kuhn introduced the concept of paradigm shifts in scientific revolutions. Prior to the publication of Kuhn’s book, most scientists believed that scientific knowledge grew incrementally. Kuhn argued that sciences advanced through both periods of accumulating knowledge and periods of revolutionary new thinking.

Paradigm shifts ask new questions regarding old problems. They expand the conceptual range of potential solutions. They advance knowledge in nonlinear ways. They usher in new-world interpretations and practices. Paradigm shifts are now a universally accepted framework for explaining revolutionary change. Clay Christensen’s models of sustaining and disruptive business innovation owe their intellectual origins to Kuhn’s work.

Healthcare’s last paradigm shift occurred over a century ago. Abraham Flexner’s 1910 report institutionalized the Johns Hopkins medical education model, closed two-thirds of the nation’s medical schools and established medicine’s tripartite mission of education, research and clinical care. The Flexner paradigm and the fee-for-service (FFS) medicine it perpetuates still predominate within U.S. healthcare.

Powerful forces are challenging the sustainability of the Flexner-era paradigm and its aligned business models. In addition to rising consumerism, they include maturing technology platforms, genetic knowledge, risk-based payment models, new competitors and greater emphasis on well-being. These forces are accelerating the industry’s push to democratize and decentralize care delivery.

A disruptive consumer-driven paradigm for health is now emerging. Medicine will never be the same. Paraphrasing Peter Drucker, incumbents that want to do something new must stop doing something old. As they embrace consumerism, they must wean themselves off FFS medicine.

Overcoming “Old Paradigm” Practices in a “New Paradigm” Marketplace

For all the rhetoric regarding risk-based payment and value-based care, FFS medicine still predominates. According to a Health Management Academy survey, [1] leading health systems made slow but steady progress in raising their percentage of value-based contracting from 15% to 25% of total revenues between 2014 and 2019 (see chart).

The most-used and least-risky form of value-based payment is shared-savings programs. As such, they are a modified form of FFS payment. Combined with pure FFS payments, they push the FFS percentage of total revenues well beyond 80%.

Channeling our Star Trek metaphor, health-systems’ “prime directive” under FFS medicine is to optimize revenues wherever and however possible. Ruthlessly pursuing revenue optimization, however, creates excessive care fragmentation, overtreatment and overpricing. It generates enormous waste and alienates consumers.

In their unending quest for payment, health systems rely on FFS medicine to sustain their operations. Unfortunately, FFS medicine is an “old math” solution to a “new math” problem. FFS medicine, as currently practiced, rewards volume and promotes manipulation of complex payment formularies. Data illiquidity and opaque pricing information limit consumer choice and channel patients into traditional, often inappropriate, treatment venues.

Source: 4sight Health

These barriers to greater consumerism in healthcare are under assault and crumbling. Healthcare’s “new math” aligns with a new paradigm that emphasizes decentralized delivery of holistic, integrated, value-based care services. Advancing consumerism, however, is not solely dependent on payment reform. Better customer experience creates incremental value within FFS medicine even as incumbents migrate to risked-based payment models.

New regulatory rules require price transparency, prevent information blocking, promote data interoperability and implement direct contracting payment models. Massive amounts of venture funding [2] are flooding into digital health companies that are building consumer-friendly care delivery channels. Big retail companies and technology companies are aggressively expanding their healthcare offerings.

These progressive market and regulatory forces turbocharge consumerism and value creation. They support care decentralization, coordination and outcome transparency. They provide solutions to real consumer problems. Delivering value to consumers is the essential feature of healthcare’s new paradigm. Creating that value will shape the industry’s future.

This paradigm shift goes beyond risk-based payment models. Value-based care amplifies the consumer’s role in service design and evaluation. In this sense, value creates great customer experiences as well as better outcomes at lower prices.

Incumbents understand that the disruptive forces described above challenge status-quo business models and practices. In response, they are prioritizing virtual and asset-light care modalities, care-model innovation, partnerships to expand capabilities and transparency solutions. However, as a recent Kaufman Hall survey [3] of health systems revealed, incumbents’ progress in implementing consumer-centric initiatives has been slow (see chart below).

Source: State of Consumerism in Healthcare 2021: Regaining Momentum. Kaufman Hall

To address COVID, health systems accelerated their adoption of virtual care services, walk-in clinics and hospital-at-home capabilities. At the same time, few have implemented innovative primary-care service models. Not expanding primary-care access poses a substantial risk for health systems as new, virtual-first delivery models emerge and switching costs decline.

Unfortunately, Health Management Academy surveys of C-suite executives reveal that COVID-related workforce and supply-chain challenges have supplanted risk-based contracting as top-of-mind priorities. While necessary, less focus on institutionalizing value-based care makes traditional providers even more vulnerable to disruptive customer-centric delivery modalities. Retaining “old medicine” payment models and practices makes it harder for incumbents to build and sustain brand loyalty.

A recent survey data compiled in Jarrard Phillips Cate & Hancock report [4] reveals high levels of support for healthcare professionals but only tepid support for hospitals. By a substantial margin, most Americans are ambivalent or don’t believe their preferred hospital is a good community partner. They also believe their preferred hospital is more focused on its business than its patients.

In essence, incumbents are losing the battle for consumers’ hearts and minds at the very time that consumer healthcare choices are expanding. Addressing service and perception shortfalls requires “one app that does it all” — single-site, omnichannel platforms that delight customers with comprehensive offerings, great service and ease of use.

Improving the digital interfaces first and then expanding service provision to encompass well-being are the two prongs propelling greater consumer engagement. Next generation platforms must automate healthcare user experiences to increase their effectiveness. They also must make it easier for individuals to manage their daily health challenges.

Platform solutions will evolve as will consumer preferences. Proactively building best-in-class consumer channels will differentiate winning healthcare companies.

Let the journey begin.

Platform Evolution

In response to the 2008 financial crisis, the federal government funded the adoption and meaningful use of electronic healthcare records (EHRs) through the Health Information Technology for Economic and Clinical Health (HITECH) Act of 2009.[5] Up to that point, the inability to standardize healthcare data for targeted transmission and analysis diminished care effectiveness and the pace of medical discovery.

Healthcare’s digital evolution began with best-of-class point solutions. This was not ideal because these point solutions did not interface well with one another. They often complicated, rather than simplified, user experiences.

As digitization of health records gained critical mass, EHR vendors resisted legislative and regulatory pressure to make EHRs interoperable and available to app developers. Administrative complexity for both caregivers and consumers increased. It remains a profound source of user frustration and caregiver burnout.

Today, even digitally mature health companies rely on patient portals tied to EHRs (e.g., MyChart) as their primary consumer interface. Enterprise-wide EHR apps coalesce patient information but haven’t won widespread activation among consumers. They aren’t personalized and require users to link to alternate sites for additional information or services.

Source: Everett Rogers

Despite being available for decades, the uptake of EHR portals typically stalls at 35-40% of patients. The yellow star in the “innovation diffusion” chart [6] illustrates the current state of consumer adoption of digital health tech applications — stuck among early-majority adopters but poised for widespread adoption.

A September 2021 report by the Office of National Coordinator for Health IT (ONC) confirms the slow consumer uptake in the use of healthcare portals. Sixty percent of those surveyed between January and April 2020 had access to online healthcare portals from their providers. Forty percent of this group accessed their portal at least once, primarily to review medical tests. This represented only a 13% increase from 2014. Only 18% of those surveyed in 2020 accessed a healthcare app six or more times.

This decided lack of consumer engagement in providers’ digital health tools is worrisome. Other industries have demonstrated the ability to spark widespread digital tech adoption by pairing new capabilities with a modern, consumer oriented UX (user experience). The window for leading the industry into digital health is significant but closing. Motivated companies can differentiate their service offerings, gain customer loyalty and expand market share by developing omni-channel platforms that enable consumers to manage their health and healthcare needs with ease.

The evolution of digital health solutions no longer requires companies to choose between clunky, data-rich EHR portals and best-in-class consumer engagement. Next generation interfaces will create an invisible organic and native experience that will inform and guide patients to improved outcomes. Make no mistake. EHRs will provide an essential system of record, but they will not be the branded interfaces that healthcare companies present to consumers.

The challenge healthcare faces today is equivalent to the one that aviation confronted in the early 2000s. American Airlines Sabre platform was the most-effective system for managing reservations, but it wasn’t consumer-facing. Sabre became an independent company and emerged as the industry’s interoperable system of record for reservations. Individual airlines now overlay Sabre with cohesive, user-friendly applications to engage consumers.

Consumer expectations for digital health and healthcare service provision are accelerating. They do not want a cacophony of disjointed applications and experiences. Consumers want and increasingly expect the consistent, non-obtrusive, and easy-to-navigate experiences they enjoy in their other retail encounters.

Incumbents’ rudimentary approaches to consumer engagement make them vulnerable to more agile, tech-enabled competitors. Great software eliminates intermediaries and healthcare is full of them (insurance companies, brokers, navigators, etc.).

The broader healthcare ecosystem sees enormous opportunity in healthcare’s continued reliance on archaic business practices. Not content with just enabling transactions, tech companies, payers and retailers are moving aggressively into care delivery (e.g., Amazon, Optum, CVS, Walmart).

Once established, consumers’ digital loyalty and preferences solidify. They become less malleable. Health systems are well-positioned to become consumers’ preferred suppliers of health and healthcare services. However, this competitive advantage window is rapidly closing as consumerism continues to gain traction and new competitors encroach into care services.

Now is the time for incumbents to make their healthcare offerings more shoppable and enriching for consumers. Differentiated solutions will encompass health as well as healthcare service provision. Voting with their wallets, consumers will establish deep relationships with value-creating companies that help them improve their daily health and well-being.

Healthcare to Well-Being

As discussed earlier, healthcare service provision is stuck in a 1920s Flexner-era operational paradigm that is hospital-centric, physician-centric, disease-focused and resistant to change. This operating orientation leaves the healthcare ecosystem ill-equipped to address the exploding levels of chronic disease that is crippling the American people.

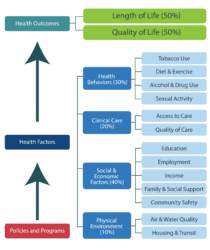

Source: County Health Rankings model © UWPHI

Clinical care accounts for only 20% of health outcomes [9] as measured by longevity and life quality. The healthcare ecosystem devotes excessive resources to the 20% and underfunds the remaining 80% (see chart). The result is a demographic conundrum where overall American life expectancy is declining while the 90+ segment [9] is the nation’s fastest growing age group.

Americans fully engaged in managing their health already have the knowledge and wherewithal to lead longer, healthier, happier and more productive lives. The life-or-death challenge for the healthcare ecosystem is to increase the number of Americans who feel empowered to manage their health and healthcare effectively.

To enhance health outcomes, payment models are evolving to reward whole-person social and healthcare delivery. Numerous new business models, most with a retail focus, also are emerging to fill this market need. Over time, resources will shift into preventive care and healthy multipliers that enhance the non-clinical components driving health outcomes.

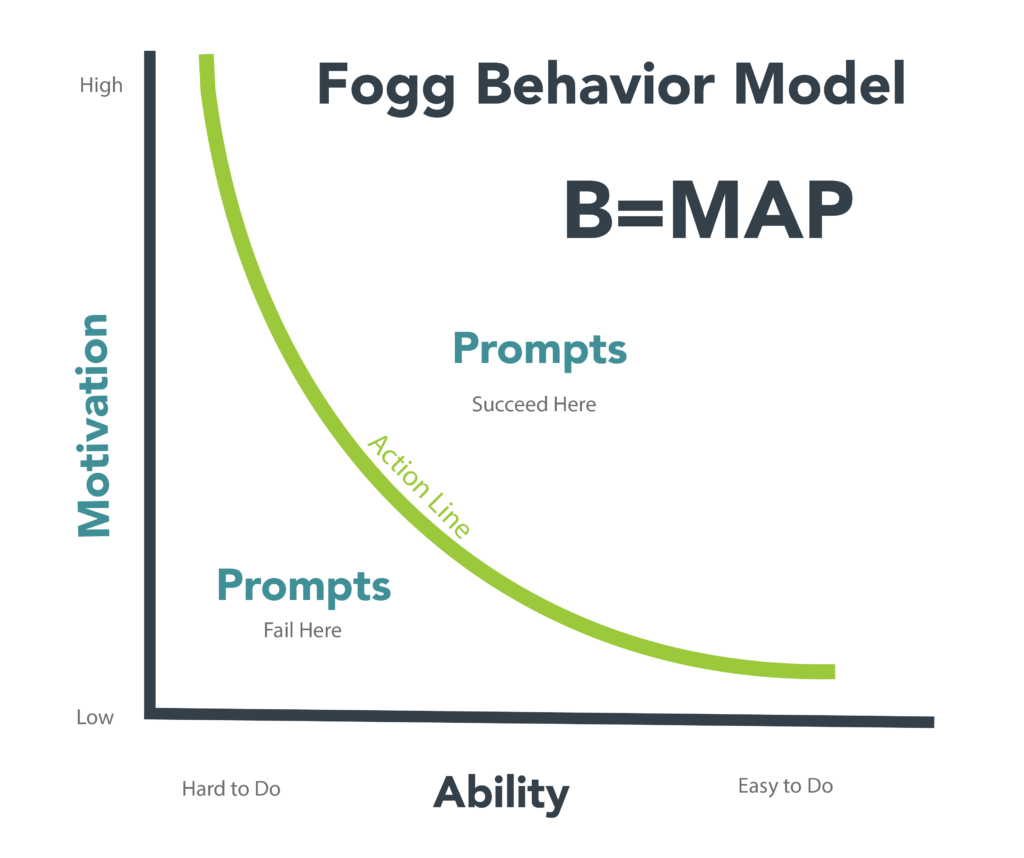

Ultimately, the health of the American people cannot improve without significant changes in lifestyle behaviors. The promise of digital health lies in its ability to make healthier lifestyle choices easier and more sustainable for consumers. According to the Fogg Behavioral Model (see chart), motivation, ability and effective prompts must converge simultaneously for desired behaviors to occur and become habitual.

Source: Fogg Behavior Model, Dr. BJ Fogg. https://behaviormodel.org/

Competing on health is very different than competing on healthcare. Developing and sustaining healthy behaviors is an ongoing endeavor. Most healthcare encounters are episodic. Enhancing motivation, making tasks easy and prompting desired behaviors appropriately are essential features of productive engagement strategies.

Digital and consumer engagement are one in the same. To fully engage consumers and maintain market relevance, health systems must tailor user experiences to individual preferences and needs through digital platforms. Engagement improves information flow, outcomes and connectivity. Consumers will reward health companies that put their interests first. Trust and loyalty build in unison as consumers choose “partners” to help them manage their health.

The best health companies will meet both consumers’ health and healthcare needs through continuous virtual and periodic physical interactions. They will promote individual and community well-being within a comprehensive array of services that solve real consumers problems. Intense ongoing engagement builds durable brand loyalty, feeds customer acquisition and enhances market presence. It creates value, and value will rule the healthcare marketplace.

User Profiles

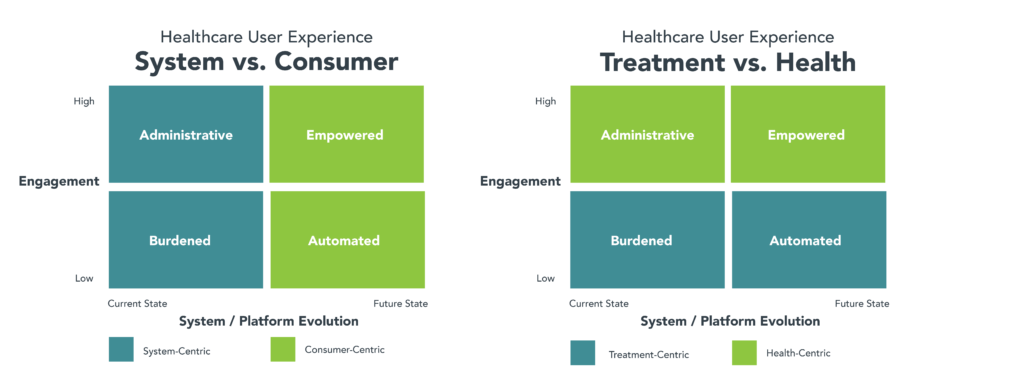

The success of digital health platforms and the services they offer depends on the platform’s technological prowess and the level of consumer engagement. Even in today’s system-centric operating environment, engaged consumers can navigate through fragmented service delivery and independently manage their health.

The challenge for health companies is to simultaneously increase the number of engaged consumers they serve and improve their digital platform capabilities. User experiences will vary depending on the levels of platform capability and consumer engagement.

With that in mind, we’ve identified the following four user profiles corresponding to current and future digital platforms as well to as low and high levels of consumer engagement: Burdened; Administrative; Automated and Empowered. We’ve further delineated these user experiences two ways: as occurring within system-centric and consumer-centric operating models; and between treatment-centric and health-centric interactions.

The user profiles have the following characteristics:

• Current state (Burdened): disconnected point solutions increase consumer friction and frustration. Rather than make their interactions with the healthcare ecosystem easier, health tech makes them harder.

• Engagement 1.0 (Administrative): enables engaged users to navigate the system with relative ease to complete basis tasks, such as scheduling, registration, bill payment, communication with providers and receiving test results. Administrative users manage their personal health and well-being independent of the healthcare ecosystem.

• Engagement 2.0 (Automated): software enables automated execution of healthcare interactions/transactions through integrated platforms that provide a consistent, nonobtrusive and easily navigable experience. Absent engagement, automated users experience much less friction when receiving health and healthcare services but fail to optimize their health and well-being.

• Engagement 3.0 (Empowered): This is the Holy Grail. Proactively enabling engaged consumers to manage their overall well-being as well as their healthcare interactions. As consumers shift from passive to active participants in their health journeys, their service expectations increase, and they migrate to solutions that best meet their needs.

These profiles are helpful for assessing the level of consumer engagement engendered within specific digital health platforms. Too many incumbents declare victory at engagement level 1.0. Ultimate success depends on automating user experiences and empowering more consumers to engage organically with digital platforms to optimize their health and well-being.

Conclusion: Living Long and Prospering

At their core, the problems plaguing the healthcare ecosystem are structural, political and/or organizational. They represent tough challenges, but they are solvable. America does not have to accept the lesser of two evils when it comes to providing great healthcare to everyone in the country.

Paradigm shifts are rare but all-encompassing. U.S. healthcare is undergoing a major paradigm shift as the ecosystem searches for new solutions to old problems. Value-driven service provision informed by and tailored to consumer preferences can reverse the negative spiral of higher costs and worsening health status that plagues America. It must. The alternative of skyrocketing costs, excessive waste and a sicker population is unacceptable.

Meta is the Greek word for beyond. Healthcare provider organizations need to go beyond healthcare and seek out new ways to engender health and well-being. Metadata is data that describes other data. Digital health is going meta by using data to inform and empower consumers to make smarter purchasing decisions. The aggregation of their individual choices will reinvent the healthcare industry.

Healthcare delivery is rapidly decentralizing and becoming more complex while consumers are demanding increased simplicity and transparency. The ecosystem is reorganizing to meet consumers’ health and healthcare needs. Achieving this vision will involve significant dislocation and system redesign. Healthcare’s new frontier will be just but demanding. There will be clear winners and losers.

Provider organizations that embrace this vision will earn customer loyalty, build brand strength and gain market share by driving better healthcare outcomes and broader community-wide health.

SOURCES

- Health Management Academy

- https://rockhealth.com/insights/2021-year-end-digital-health-funding-seismic-shifts-beneath-the-surface/

- State of Consumerism in Healthcare 2021: Regaining Momentum. Kaufman Hall, September 2021. https://www.kaufmanhall.com/sites/default/files/2021-09/kh-2021-state-of-consumerism-survey-report_final-9.15.pdf

- NATIONAL HEALTHCARE SURVEY EXECUTIVE SUMMARY. Dark Suits & White Coats: Healthcare’s Acute Divide. January 2022. https://1m99by38qbvs3fwojw3yggct-wpengine.netdna-ssl.com/wp-content/uploads/2022/01/Jarrard-National-Survey-4.0-December-2021-Executive-Summary.pdf

- Health Information Technology for Economic and Clinical Health (HITECH) Act. February 28, 2009.

- Everett Rogers from The Use of an Electronic Health Record Patient Portal to Access Diagnostic Test Results by Emergency Patients at an Academic Medical Center: Retrospective Study. J Med Internet Res. 2019 Jun; 21(6): e13791. Published online 2019 Jun 28. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6625217/

- https://www.healthit.gov/data/data-briefs/individuals-access-and-use-patient-portals-and-smartphone-health-apps-2020

- https://www.countyhealthrankings.org/explore-health-rankings/measures-data-sources/county-health-rankings-model

- 90+ in the United States: 2006–2008 American Community Survey Reports, issued Nov. 2011. https://0.tqn.com/z/g/usgovinfo/library/nosearch/90_plus_in_us.pdf

Disclaimer

The information contained in this report was obtained from various sources, including third parties, that we believe to be reliable, but neither we nor such third parties guarantee its accuracy or completeness. Additional information is available upon request. The information and opinions contained in this report speak only as of the date of this report and are subject to change without notice.