November 11, 2025

OpenEvidence: Disruptive or Not?

In case you missed it, OpenEvidence has been changing the rules of competition, so I’m going to analyze the business model through the lens of the Christensen Institute’s six-question test for disruptive potential.

This test, which has come up in my previous 4sight Health contributions, is valuable because Disruptive Innovation is a theory of competitive response. Therefore, the value of knowing whether something is disruptive or not means you can predict how leading players in the market will respond, and how that response is likely to play out.

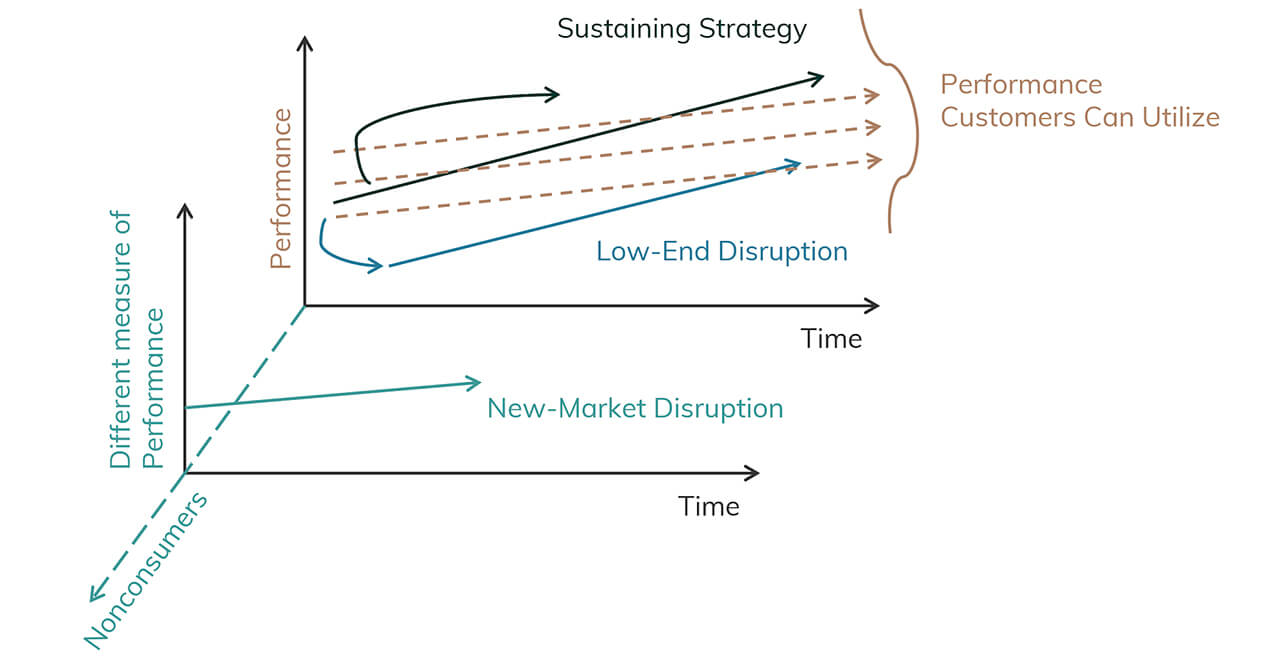

When new entrants come into an industry and go after the leading providers’ best customers, they are usually entering a sustaining innovation — not a disruptive innovation — fight. In that situation, those incumbent leaders are going to fight back, and they’re likely to win. But if startups enter at the bottom of the market with a cheaper product that’s not as good as prevailing solutions and serve nonconsumers or those who can’t afford existing solutions, incumbents are likely to ignore the potential disruption.

When new entrants come into an industry and go after the leading providers’ best customers, they are usually entering a sustaining innovation — not a disruptive innovation — fight. In that situation, those incumbent leaders are going to fight back, and they’re likely to win. But if startups enter at the bottom of the market with a cheaper product that’s not as good as prevailing solutions and serve nonconsumers or those who can’t afford existing solutions, incumbents are likely to ignore the potential disruption.

That’s okay at first, but disruptions don’t stop where they start. They move upmarket, ultimately displacing the industry leaders: Netflix and Target are two great examples.

OpenEvidence: A Quick Overview

OpenEvidence says it wants to be the single source of truth for medical decisions at the point of care. To do so, it gives clinicians the ability to search once, skip the hunt and find for answers, and surface the latest evidence in seconds. The founder, Daniel Nadler, calls OpenEvidence a copilot for clinicians.

The company’s mission is to organize and expand global medical knowledge, an increasingly challenging feat for humans, given that medical literature is doubling in size every five years.

Effectively, OpenEvidence is medical ChatGPT with better citations and without the hallucinations. And it’s growing really quickly. The founder claims 40% of physicians are on the platform and that it is growing by 65,000 providers per month. If true, it’s clear OpenEvidence has already won physicians’ trust much faster than any other AI tool out there. Additionally, its annualized revenue is estimated at $50 million.

This sounds amazing. Won’t it disrupt healthcare delivery as we know it?

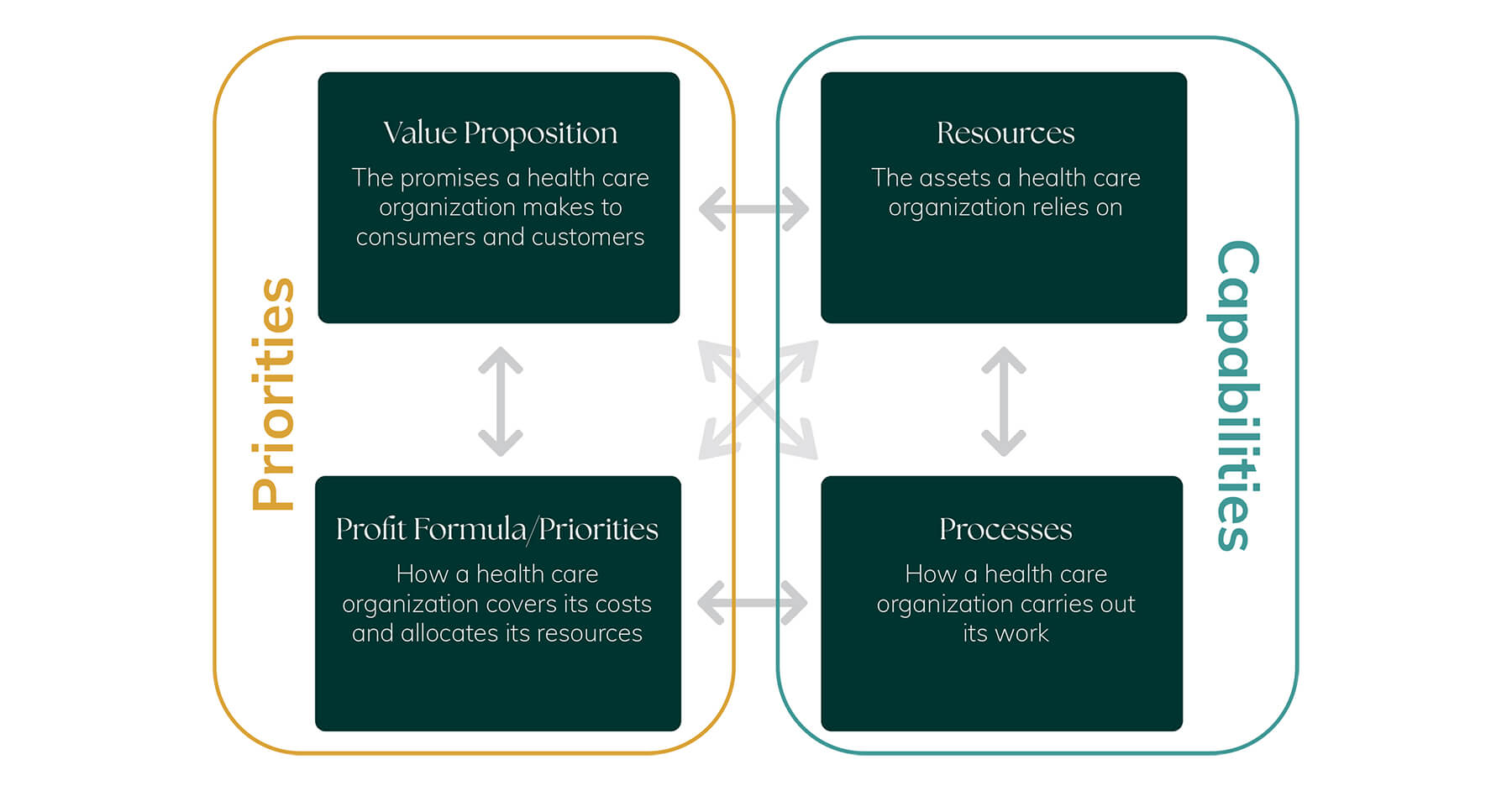

Maybe, but not in the near term. Yes, it will change the processes of medical practice. In fact, it already has. But processes alone aren’t disruptive, and neither are technologies. Business models disrupt business models. And, disruption is relative. The question is, “Is OpenEvidence disruptive relative to __________.” For the purpose of this analysis, I’m comparing it to UpToDate.

Let’s go through each of the six questions one by one.

1. Does OpenEvidence target nonconsumers or people overserved by the incumbent’s offering?

Disruptors have an opportunity to enter the market when existing solutions are too expensive or too hard to access. UpToDate is expensive (~$500/license/year), so small practices, startups or lone providers are often priced out of the market. OpenEvidence, however, is free to anyone with a U.S. National Provider Identifier (NPI). This free-to-clinicians model is likely one reason it’s grown so fast. Laypeople can use it but are capped at a few questions per month, likely so as not to create a lot of useless data. More on that in a minute.

So, given the expense of UpToDate and competitors like it, there is a portion of the market that is priced out. Therefore, we’d say “yes” to this question because OpenEvidence is a lower-cost (currently free) solution that serves nonconsumers. However, OpenEvidence also targets incumbents’ best customers.

2. Is it not as good as an incumbent’s existing offering as judged by historical measures of performance?

No. OpenEvidence isn’t performing worse than UpToDate on the prevailing measure of performance (i.e., providing the latest medical evidence at the point of care). It’s performing as well as, or better in terms of accuracy, and better in terms of speed.

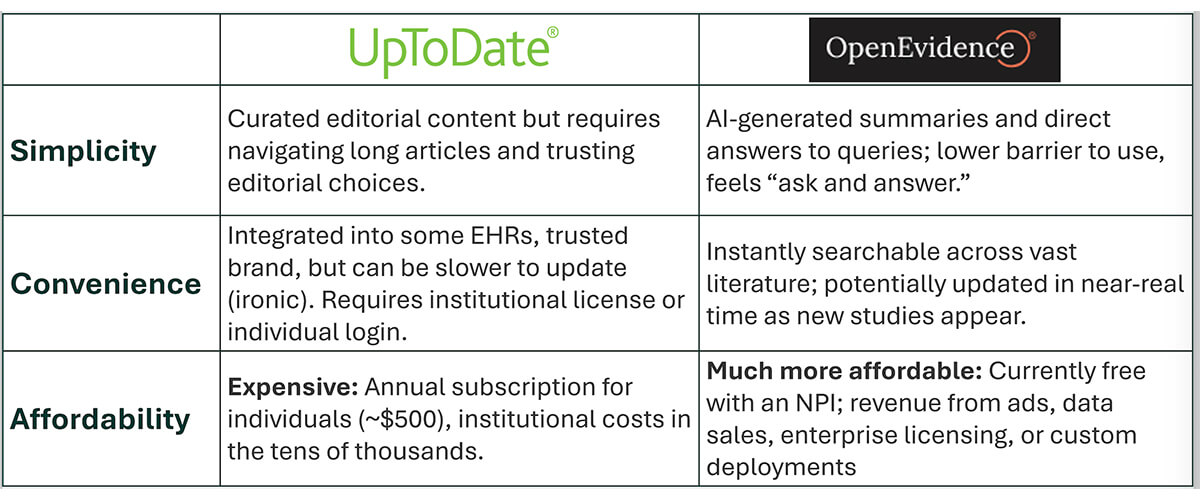

3. Is the innovation simpler to use, more convenient or more affordable?

This question is best addressed by a chart.

In summary, OpenEvidence is simpler to use, probably more convenient, and definitely more affordable. So, the answer here is “yes.”

4. Does it have a technology enabler that can help it move up market?

Yes, the AI platform, but it’s not clear that this is a unique enabler (more on this in the next response). Notably, it is moving upmarket quickly, with the launch of DeepConsult in July, and Visits in August. With the launch of Visits, OpenEvidence is now going head-to-head with clinical assistants and clinical documentation tools.

5. Is the technology paired with a business model innovation that allows it to be sustainable?

The answer here is “maybe, but not yet.” When assessing OpenEvidence’s model, I have a big question as to whether one of its key resources, its AI platform, is truly defensible. Blake Madden, of Hospitalogy, and Rik Renard, of Sword Intelligence, arrived at a similar conclusion, which you can read here.

OpenEvidence currently has a first-mover advantage in AI-enabled clinical decision making, with a $3.5 billion valuation to prove it. But will it last? Doximity, which recently purchased OpenEvidence’s smaller competitor, Pathway, has already shown that it finds OpenEvidence threatening, as demonstrated by attempts to steal OpenEvidence’s code. OpenEvidence sued. Doximity sued back, naturally.

While OpenEvidence is currently widely popular with doctors (see uptake stats above), others like UpToDate and Epic have a distribution benefit with healthcare organizations.

OpenEvidence went straight to the consumer with a free product, which was a great growth play. But incumbents like UpToDate and Epic have institutional trust and buy-in. For OpenEvidence to have a sustainable business model, they have to find a way to sustainably monetize this individual buy-in. This can clearly be done, as Doximity has demonstrated through its ad-based revenue model.

Currently, OpenEvidence is making a similar bet: monetize provider usage through ad sales. While analysts state that these are primarily pharma and medical device ads, clinicians I’ve asked about their use of OpenEvidence say they only see JAMA and NEJM ads, or no ads at all. That seems like a fairly large disconnect, but it’s anecdotal, so take it for what it’s worth. The OpenEvidence website also states that they sell data, and enterprise licensing is another revenue opportunity. In terms of an innovative business model, they don’t seem to have one. They seem to be aligned with Doximity’s revenue model playbook.

A key resource that OpenEvidence has to support business model viability is clinicians’ trust. This shouldn’t be undervalued. Highly acclaimed management author Stephen Covey claims that change moves at the speed of trust, and OpenEvidence’s adoption rate suggests this is true. The trust it has built with individual providers may in part be due to OpenEvidence’s established partnerships with JAMA and NEJM: Clinicians know they can trust the answers because they come from reputable sources.

To know if OpenEvidence has long-term business model viability, we need more time to see how a number of factors play out:

- Can others effectively replicate their AI platform? Doximity, Epic and others are certainly trying. Doximity is a well-established platform of choice for providers, and Epic is used by 42% of hospitals in the U.S.

- Are their revenue sources sustainable? Is pharma really paying them for ads?

- With answers to these key questions in the balance, it’s unclear to me if the business model is really innovative or unique. In all fairness, I have been known to over-rotate on the business model, so I may eat my words on this later.

6. Are existing providers motivated to ignore it and not feel threatened at the outset?

No. While OpenEvidence serves nonconsumers of UpToDate, it also goes after its best customers. And, as we’ve seen in the lawsuits referenced above, industry incumbents aren’t just sitting by and watching OpenEvidence go after its best customers without a fight. When startups go after incumbents’ best customers, they are usually entering a sustaining innovation fight, and in those situations, incumbents are poised to fight back, and they often win.

Because of the answers to these six questions, I don’t believe OpenEvidence poses a true disruptive threat. Technology alone isn’t disruptive. It must be wrapped in a business model that enables disruption.

But… that’s not the end of the story.

Another Way to Compete and Win in the Market: Nail the Job to Be Done.

Just because OpenEvidence doesn’t match the criteria of a Disruptive Innovation (based on what we know right now), that doesn’t mean it can’t change the market. Disruption follows a specific trajectory: It starts at the bottom of the market with a less expensive, not-as-good product, serving nonconsumers. Then it moves up market, gradually winning over customers as its product or service improves. While OpenEvidence may serve nonconsumers who are priced out of the market because of UpToDate’s prevailing price points, that in and of itself doesn’t make it a Disruptive Innovation. It’s going after the entire provider market, highlighting the sustaining nature of its product.

Instead of competing on a disruptive strategy, OpenEvidence may change the market because it serves a Job to Be Done better than alternatives. Its quality isn’t worse than incumbents. In many ways, it’s better.

Who else executed this strategy? A lot of companies, but Uber comes to mind as a good example. Uber is not a Disruptive Innovation. But that doesn’t mean it didn’t nail a Job to Be Done and compete effectively against incumbents because of it.

So, in summary, while OpenEvidence doesn’t check enough boxes to be deemed a potential Disruptive Innovation, theory does suggest it could change the market based on how well it serves a Job to Be Done along the lines of, “When I’m pressed for time and don’t know the latest evidence base, help me find the most accurate answer, so I can confidently help my patient improve.”

OpenEvidence isn’t a Disruptive Innovation, but it’s still a game-changer.