April 17, 2017

“Indumbent” Healthcare Thinking: Prices Don’t Matter

In a March 29th New York Times article, author Elizabeth Rosenthal chronicles America’s dystopian system for coding and billing medical treatments. Rosenthal concludes that the medical-billing system itself is a primal cause of the nation’s sky-high medical costs,

That system, with its lines of alphanumeric codes and arcane medical abbreviations, has given birth to a gigantic new industry of consultants, armies of back-room experts whom medical providers and insurance companies deploy against each other in an endless war over which medical procedures were undertaken and how much to pay for them.[1]

Rosenthal’s analysis illustrates a core truth about American healthcare: prices rarely matter. Healthcare companies strive to optimize reimbursement revenue per treatment. Payments for healthcare services ping pong between payers and providers as they manipulate complex reimbursement formularies for their own advantage. While titans battle, patients wrestle with incomprehensible bills, treatment denials and uncoordinated care delivery.

In this “revenue-first” operating environment, prices separate from costs, value is ephemeral, waste is breath-taking ($1 trillion annually) and patients are an after-thought. Entrenched incumbents across all sectors (payers, providers, device manufacturers, drug companies, intermediaries and consultants) engage in these reimbursement contests with virtuoso skill and devastating success. Healthcare wins and society loses.

Incumbent thinking, however, is becoming “indumbent” thinking. New business models are emerging that deliver better healthcare for less money with transparency and great customer experience. Old-world managerial mindsets with reimbursement-first instincts are ill-equipped to compete on price, outcomes and customer service. Healthcare markets are changing. Health companies must adapt or die.

The Reimbursement-First Managerial Mindset

Differential payment for identical procedures is the defining feature of American healthcare. Complex reimbursement codes are the currency through which commercial and governmental payers reimburse hospitals and doctors for the treatments they provide.

Maximizing reimbursement is Job 1 in almost all large health systems. They build robust revenue cycle capabilities to capture the most revenue possible. Sophisticated revenue cycle systems employ data mining, coding formularies and predictive analytics to optimize claims collection.

Minor adjustments to treatment protocols can increase reimbursement substantially. Doctors change behaviors to incorporate these adjustments. They spend more time documenting treatments for billing purposes than providing care. This is a principal cause of physician burnout.

Commercial health insurance claims are substantially more lucrative for providers. Health systems and health insurers employ legions of highly-trained coders to negotiate payment for specific claims. Health systems bill to maximize reimbursement. Health insurers deny claims to minimize payment. Resolution often takes months.

This payment battle between large health insurers and health systems dominates U.S. healthcare. Incumbents exhibit entrenched behaviors that benefit both payers and providers. This is a zero-sum equation. American society pays for healthcare’s profligacy through lower wages, lower productivity and declining global competiveness.

Incumbent or “indumbent” mindsets calcify attempts to bring value to healthcare delivery. They fail to see the link between better outcomes and lower prices. They frustrate attempts to disrupt unproductive business models that add cost without adding benefit.

Most importantly, indumbent mindsets prevent health companies from undertaking transformational change. Health companies make incremental improvements on flawed business models rather than embrace transformative business models with different capabilities and lower cost structures.

Indumbent thinking is self-inflicted and destructive. Indumbent thinking prevented Kodak from recognizing the competitive threat posed by smartphone cameras. Indumbent thinking prevents many health companies from appreciating existential threats to their high-cost and inefficient business practices.

The Market-Oriented Managerial Mindset

In normal markets, prices have the power of language. They signal information from sellers to buyers regarding the perceived value of offered products and services. Transactions occur when buyers have the inclination and means to purchase desired products and services. In this way, buyers become customers. Transactions are value-based exchanges undertaken willingly by both parties.

Successful companies employ market-oriented managerial mindsets where managers maximize value creation (and profits) by finding optimal relationships between prices, costs and product/service demand. Customer needs and perceptions are the principal considerations. Apple has become the world’s most valuable company by making its products desirable, affordable and accessible.

Pricing transparency and value-based service delivery are coming to healthcare. For example, Best-in-Class Care is an early-stage, Chicago-based company that combines medical tourism with “Expedia-like” travel services to offer a one-stop shopping experience for those requiring specific treatments, second opinions and/or tele-consults. The company has built a world-wide care network with highly-accredited providers, transparent pricing and concierge support-services.

Best-in-Class Care recently began booking procedures and the early reviews are terrific,

I was one of my plans first members to try Destination Medicine! I received a first-rate shoulder reconstruction surgery a few weeks ago and am back home on the mend. This is the perfect opportunity for anyone with a little sense of adventure and an eye for savings.

*****

All went well at Pittsburgh. Really nice facility in a nice area of Pittsburgh. Everyone was at their best since they knew about my Best-in-Class Care connection. Even had a visit from the surgery center administrator.

*****

Customers book the procedures directly, get their questions answered, consult in advance with caregivers and know exactly what their costs will be. Procedure price is an essential component of customers’ purchasing decision. Value is apparent. Customers win.

Indumbent Thinking in Action

In healthcare, transactions occur without customers. Patients see doctors. Doctors tell patients what to do. After limited co-pays and deductibles, a third-party insurer pays for the prescribed service. Healthcare transactions sever the direct buyer-seller interactions that establish supply-demand relationships in normal markets.

To supplant market-based pricing dynamics, healthcare substitutes complex payment formularies that lend themselves to manipulation and fraud. In their efforts to “win” disputes over treatment reimbursement, both health systems and health insurers have lost sight of the paramount role prices play within efficiently-functioning markets.

This “blind spot” limits incumbents’ ability to respond to market demands for greater value in healthcare delivery. They lack the internal capabilities to respond effectively to market signals demanding better healthcare at lower prices. This deficiency creates opportunities for new business models to deliver superior healthcare services to value-driven customers who care about prices.

Best-in-Class Care’s difficulty in building its U.S. provider network illustrates both the challenge and opportunity for market-oriented health companies. International providers readily quote all-in prices for specific procedures that Best-in-Class Care can publish on its website. U.S. providers almost never do.

With very few exceptions, U.S. providers will quote cash prices for specific procedures, but are unwilling to publish those rates. They worry about setting precedent with payers who could use transparent procedural prices to reduce reimbursement payments for equivalent procedures.

This is “indumbent” thinking in action. Providers protect their near-term negotiating advantage with payers while leaving themselves vulnerable to the longer-term trend toward pricing convergence for routine procedures.

Old Math New Math

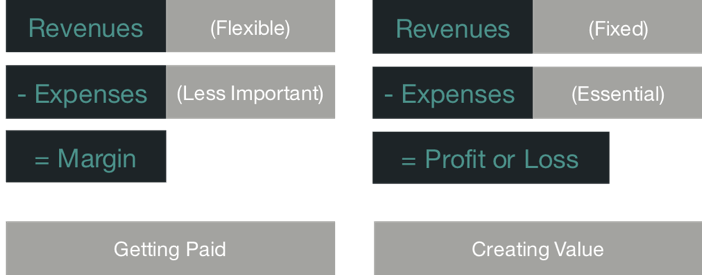

Healthcare’s New Math

The chart above contrasts healthcare’s old and new math. In traditional healthcare economics, revenues are flexible and subject to manipulation. This accounts for health systems’ enormous investment in revenue cycle capabilities. They win by optimizing revenues, not controlling costs. “Getting paid” is the organizational mantra.

In well-functioning markets, the supply of products and services offered adjusts to an intrinsic level of customer demand. Prices for commodity products and routine services are highly elastic. Higher prices reduce demand. Consequently, prices coalesce around fixed “price points.”

In such markets, managing expenses effectively is essential for profitable operations. Robust cost accounting capabilities drive constant performance improvement, tight pricing algorithms and efficient resource utilization.

In competitive markets, “creating value” distinguishes winning companies. They deliver high volumes of high-quality products and services at low prices with exceptional customer experience (think Amazon).

In the land of the blind, the one-eyed woman is queen. Health systems that become more price transparent, align prices with costs and sell value-oriented treatments will increase market share. Lagging health systems will lose relevance.

Gravity Wins

Most healthcare services are routine. They occur frequently, have predictable outcomes and invite standardization. Fighting against commodity-based pricing for routine services is like fighting against gravity. It takes enormous energy and is doomed to failure.

Mark Twain famously observed, “It’s not what you don’t know that will kill you. It’s what you know for sure that just ain’t so.” Indumbent mindsets believe current reimbursement practices will continue for the foreseeable future. It just ain’t so.

American consumers are value-seeking missiles. As the American healthcare marketplace normalizes, they will use well-honed purchasing instincts to find and reward higher-value providers.

A more effective provider strategy would be to accept that prices for routine care will rationalize and build business models that deliver routine care efficiently and profitably. Enlightened health systems will get ahead of the curve by giving customers the high-value care they increasingly demand.

Value-based care is coming to America. Like the Pilgrims at Plymouth Rock, early practitioners of transparent healthcare pricing are establishing a permanent foothold and expanding outward. Outcomes matter. Customers count. Value rules!

[1] Elizabeth Rosenthal, New York Times, “Those Indecipherable Medical Bills? They’re One Reason Health Care Costs So Much”, March 29, 2017