April 8, 2020

Now Is The Time. Time To Reconfigure Routine Care.

In our recent article we identified the following five margin pressures that are coalescing to drive more value into the delivery of healthcare services:

Their collective impact poses a prominent threat to many health systems. Consequently, “business-as-usual” is no longer a viable long-term strategy. Strategic partnerships, reconfiguring routine care, increasing productivity and effective revenue management are strategies health systems can pursue to enhance their competitiveness. This article will examine the dynamics and potential of reconfiguring routine care.

Mature and Vulnerable

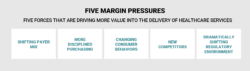

From a services perspective, healthcare is a mature industry. Providers have established protocols with predictable outcomes for the vast majority of patient care needs. This matrix identifies the categories of care delivery based on care uncertainty (episodic to ongoing) and risk (low to high).

The Shift From Specialty Care to Routine Care

With most medical treatments being routine and subject to commoditization, consumers have a tendency to judge quality based on speed, convenience and service. Commodity care is a high volume, low-margin business. Specialty care requires “focused factories.” Complex care is a “solutions shop” business. Chronic care requires intense, non-acute customer engagement.

Health systems that deliver superior specialty and complex care can enjoy premium pricing. Consumers with high outcome uncertainty will seek care at prestigious tertiary care centers with established expertise, top performance ratings and sterling reputations. Achieving a successful outcome will be their principle selection criterion. Price will be secondary.

Unfortunately, most care delivery is migrating into the commodity and chronic care quadrants. Once upon a time, knee replacement surgery was high-end specialty care. Few institutions had the expertise, experience and protocols necessary to perform this complicated procedure. Outcomes were less certain. Patients paid premium prices.

Today, hospitals and ambulatory centers perform knee replacement surgeries at a high volume throughout the country. There is abundant comparative data on outcomes, prices and consumer experience. Consequently, knee replacement surgeries are now routine and increasingly subject to pre-set bundled prices.

The future of routine care delivery belongs to integrated, high-volume, low-margin providers that offer convenient, customer-friendly healthcare services.

Currently, most health systems deliver services across all four quadrants. This broad approach to service provision often translates into subpar performance on outcomes, cost and customer experience relative to more focused competitors.

While there is overlap, each quadrant has different types of consumers and requires different business models to succeed. This creates significant opportunities for companies with new and innovative business models to address consumers’ healthcare needs effectively, provide superior service and make prices transparent.

Redefining the Healthcare Marketplace

Fueled by record levels of private equity and venture funding, new market entrants in healthcare services search for opportunities to address unmet market needs and/or exploit existing inefficiencies. Unlike health systems, these new entrants are not trying to be all things to all patients. They target their investments where they can achieve a competitive advantage.

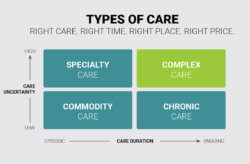

More companies with novel healthcare businesses models are emerging in the commodity and chronic quadrants. In classic disruption fashion, these companies are entering the quadrants of least interest to established incumbents. New companies provide routine services in convenient new ways that appeal to consumers – cost-effectively and efficiently.

For example, SmartChoice MRI offers $600 (or less) MRIs (Magnetic Resonance Imaging) throughout metropolitan Chicago in convenient centers that operate six days a week. After an on-site read, clinicians from the Cleveland Clinic review each SmartChoice MRI for diagnostic accuracy. SmartChoice advertises that imaging services are commodity care and should have commodity prices and that, “MRIs shouldn’t cost an arm and a leg” and hails its platform as “the cure for the $2,600 MRI.”[1]

At this turning point in the industry’s history, established healthcare companies that ignore new market entrants do so at their own peril. The chart below depicts the four types of new market entrants that are entering into the commodity, specialty and chronic care quadrants and causing disruptive care. Competition among national and regional referral centers will help define the future shape of complex care delivery.

Enhanced primary care companies are the most transformative and disruptive of these four delivery models. Their high-touch engagement and personalized care plans enables them to build trust with consumers and help reduce demand patterns for acute care services. These novel business approaches do not exist in isolation. They complement one another.

Many asset-light, focused-factory and retail health businesses incorporate enhanced primary care, telemedicine and digital care services into their operations. They understand that the future of routine care delivery belongs to integrated, high-volume, low-margin providers that offer convenient, customer-friendly healthcare services.

“Platforming” Healthcare Services

What can health systems do to sustain their market relevance in this rapidly changing market environment? Management guru Peter Drucker famously observed, “If you want to do something new, you have to stop doing something old.”

Drucker’s advice applies; irrespective of industry, consumer perceptions of quality shift from outcomes to convenience, price and customer experience as products and services commoditize. Health system leaders cannot expect the healthcare marketplace to continue paying premium prices for routine services.

With most medical treatments being routine and subject to commoditization, consumers have a tendency to judge quality based on speed, convenience and service.

In mature service industries like healthcare, service providers decentralize to lower prices and become more convenient for consumers. Health systems that embrace this same logic and “go retail” to provide routine services will be better able to deliver greater outcomes and a greater customer experience at lower prices to remain competitive.

Fortunately, health systems do not have to create new business models from scratch to develop asset-light, consumer-centric services. They can partner with companies that offer specialized expertise, creating a cohesive platform that tailors its products and services to consumers’ health and healthcare needs.

Amazon-like care delivery companies are emerging within healthcare. A few examples include OneMedical, Go Health and United Surgical Partners International (USPI). These companies link multiple capabilities within integrated and digitally connected delivery platforms to deliver personalized care services to consumers on their terms. In this sense, these platform companies become partners with their consumers in their individual health and healthcare journeys.

Consequently, the business of effectively delivering routine care services is anything but routine. Routine care organizations require a sophisticated organization of business functions to deliver the right care at the right time in the right place at the right price.

Sources

Co-author

Jeff Jones serves as Chief Commercial and Strategy Officer for Conifer Health Solutions. In this role, he defines the strategic direction for Conifer including the enterprise strategy, strategic partnerships, leads all commercial activities, heads client service and delivery, owns brand, marketing and go to market strategy, and directs new solution innovation. Jeff joined Conifer’s Executive Leadership Team in September 2019 bringing with him over 30 years of industry experience.

Jeff Jones serves as Chief Commercial and Strategy Officer for Conifer Health Solutions. In this role, he defines the strategic direction for Conifer including the enterprise strategy, strategic partnerships, leads all commercial activities, heads client service and delivery, owns brand, marketing and go to market strategy, and directs new solution innovation. Jeff joined Conifer’s Executive Leadership Team in September 2019 bringing with him over 30 years of industry experience.

Jeff’s experience in both the healthcare and technology industries coupled with his demonstrated track record partnering with health systems, academic medical centers, specialized providers, medical groups and health technology companies allows him to bring unparalleled insights into Conifer’s overall business.