December 19, 2023

You’re Doing it Wrong, Health Systems! Getting the Experience Right Increases Revenues, Satisfaction and Profits

Almost every health system boldly proclaims that they are “patient-centric” and emphasizes that being patient experience is their singular focus. And they mean it. Unfortunately, their sincerity belies a terrible underlying truth.

Customer experience (CX) within health systems, particularly within revenue cycle operations, is sub-par at best and often flat-out lousy. Too often, this experience means enabling online bill payment and related communication, but fails to actually listen to patients. Lousy CX within revenue cycle depresses revenue collection and increases direct labor costs while alienating patients and employees alike.

It doesn’t have to be this way.

Other industries have highly developed CX methodologies and reap the benefits in terms of increased market share, lower costs, and delighted customers. These methodologies are applicable to the provider world, which means there’s hope for organizations humble enough to recognize that it’s time to think differently.

Financial Experience Is Customer Experience Too

Research by the Healthcare Financial Management Association (HFMA) has found that CX, also known as patient experience (PX), is among health systems’ top areas for investment. Many hospitals have chief experience officers supported by large departments, and almost every hospital has appointed someone to head up their patient experience efforts.

Their collective job is to improve patient experience and satisfaction for an increasingly demanding customer base. Engaged consumers expect more than digital access for routine healthcare services. They want engagement and easy-to-access solutions for their individual healthcare journeys.

For most providers, HCAHPS scores and patient surveys feature prominently in hospital-based performance metrics. Relying on HCAHPS surveys and metrics to drive CX, however, fails to capture the totality of patients’ care journeys.

While HCAPHS reports provide broad indicators of patient experience, their questions and metrics focus principally on bedside care. While quality care is the ultimate goal for every patient experience, the reality is a provider organization interacts far more frequently in administrative tasks before, after, and sometimes even during the clinical episode. As a consequence, HCAHPS reports offer little insight into the operational failures and unmet consumer needs that routinely occur in the administration of healthcare services, most notably in payment-related activities.

This does not get the CX job done, at least not to the degree that a truly patient-centric organization should. As a consequence, the billing and collection experience within hospitals generally alienates rather than engages patients. Only the most vigorous complaints make their way to healthcare executives, generating an undercurrent of patient frustration and dissatisfaction.

Consumer anger generally simmers below the surface, but occasionally boils over and becomes a public issue. This ongoing negative sentiment draws periodic media attention and governmental remediation. It also underlies the industry’s pathetic consumer appreciation scores. A bad financial experience can erase the goodwill generated by a positive clinical experience. This should never happen.

It’s maddening that almost all health systems exclude revenue cycle operations from their portfolios of CX investments. This is a costly mistake. Revenue cycle interactions generate rich transaction-level information on virtually all patient encounters that hospitals can use to improve the totality of a patient’s customer experience. Happy customers are paying customers.

This lesson was learned long ago by other industries.

Active Listening and Response

Robust CX programs are not just for goodwill or filler in a community impact statement — done right they generate tangible financial returns:

- Telecommunications provider DISH used advanced analytics to power a program that detected when a customer was dissatisfied. Identification of an unhappy customer triggered near-real-time service recovery. The result was a 10-point increase in NPS and $15 million in financial improvements.

- When yogurt manufacturer Chobani introduces a new product, it uses customer feedback to determine which attributes are most important to prospective new customers and to identify new customer categories. Through this customer-centric process, they have achieved more than 200% annual growth and captured 16% market share for their most recent product launch.

Customer experience (CX) efforts in healthcare barely scratch the surface of customer satisfaction programs in other industries. Health systems rely on surveys with significant time lags that compromise their ability to respond to customer complaints in real time. Moreover, most health systems have limited infrastructure in place to identify and/or respond to bad patient experiences.

Model CX Programming

Health systems that are serious about improving patient experience need to expand their thinking beyond the mechanical elements of digital front doors. They must incorporate CX programming that builds and maintains deeper, more meaningful patient/customer relationships. The Customer Solutions Matrix identifies the incremental components of effective CX programming as organizations respond to differing levels of customer need.

Customer Solutions Matrix

The healthcare industry is mired in the lower left — focused on creating digital tools that providers believe will make patients happier with little actual data to support that conclusion. In essence, they’re deploying the most resources to where they will have the least effect.

To the extent hospitals venture into the regions to the upper right, it is almost always a one-off response to a high-profile complaint or unique service breakdown. In those rare instances, an executive or customer service representative goes “above and beyond” for a particular patient.

Other industries have moved aggressively into the “solve my problem” and “advocate for me” sectors of the matrix. They listen actively and carefully to their customers. Through this information exchange, enlightened companies gain an understanding of their customer service needs and then respond to those needs aggressively. In return, those customers display higher loyalty and a greater willingness to pay for goods and services.

Closing the Loop

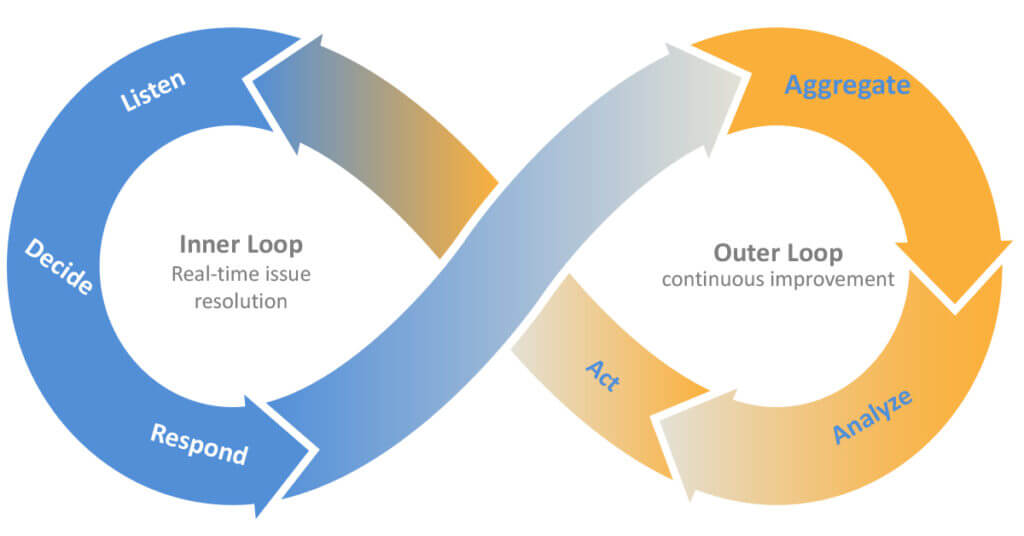

Individual complaints often emerge from endemic system failures. Consequently, these companies often employ a “closed-loop” approach (see graphic below) to solve individual problems while aggregating data to identify patterns of complaint and opportunities for systemic improvement.

Closed-Loop CX Systems Foster Near- and Long-Term Solutions

Within the “Inner Loop,” companies identify actionable customer experiences in near-real time and then activate appropriate responses. Effective CX platforms employ a variety of advanced listening techniques, including chat and voice analytics, to identify and refine a customer service issue. Once the platform identifies and analyzes a service issue, it determines a targeted response and triggers a resource request to address and solve the problem.

Within the “Outer Loop,” companies aggregate and analyze CX data from individual encounters to identify broad patterns of complaints, conduct root-cause problem assessment and move pre-emptively to eliminate or reduce the incidence of repeated complaints. Analytics source incidences of good performance (to identify and share internal best practices) as well as process failures (to identify and correct systemic service deficiencies).

The results for companies employing “closed-loop” service analytics are tangible and significant. Health systems should take note.

Health System Application

Effective CX is not rocket science, and with the wealth of data available the revenue cycle is a target-rich environment for high-return investments. Health systems can leverage its revenue cycle operations with relative ease to increase revenues, lower costs, improve employee retention and generate higher patient satisfaction scores.

Health systems can extract data from scheduling and customer service call centers to create “Inner Loop” problem identification and solution mechanics. Aggregating this information with data from online tools and financial services (e.g. denials, outstanding balances, credit balances, etc.) creates a robust dataset for “Outer Loop” identification of and solutions for systemic CX problems.

One case study is worth a thousand pictures. Within the inner loop, one hospital closed-loop CX programming generated over 7,000 outbound service recovery calls from five dedicated FTEs over a six-month period. Outer-loop analytics identified multiple process failures, including broken payment links and inadequate staff training on proper handling of credit balances.

While the value of patient goodwill and aligned future revenues is challenging to measure, improvement in cash collections is not. Patient cash collections at this hospital increased by more than 15%. Furthermore, inbound call volumes were cut in half, relieving a significant staffing cost for the hospital. Better collections performance also reduced staff frustration and turnover in the hospital, saving the organization several million dollars in associated costs. Overall the hospital estimates at least 10 times the ROI from its inner- and outer-loop CX investments.

Here’s the cherry on the sundae. In addition to improved financial returns, the hospital’s patient satisfaction scores improved by more than 10%. There is an obvious conclusion here. There are few if any current hospital CX investments that can generate this high level of both financial- and service-level returns.

There’s No Time to Waste – Start Doing It Right!

It is time for health systems to move beyond sending paper surveys and enabling digital tools. More dynamic patient relationships require a deeper understanding of patients’ needs. Knowing customers means identifying their likes and dislikes. This customer-specific knowledge informs and shapes targeted CX responses.

Given its data intensity and importance to organizational performance, revenue cycle operations is the logical area to launch a closed-loop CX platform. Effectively implemented, closed-loop systems with revenue cycle increase collections, patient satisfaction and employee retention. The good news is that these investments not only pay for themselves, they establish a solid foundation for CX improvement in other areas, most notably in patient care.

Providers that listen to their patients and act to address their concerns will create a significant competitive advantage within a consolidating acute-care marketplace. Happy customers are the key to better financial returns and long-term financial sustainability. Health system executives can take that to the bank!