August 8, 2017

Advantage Medicare Advantage: Delivering Healthcare’s Triple Aim to America’s Seniors

Hitting the Sweet Spot for Patients and Providers

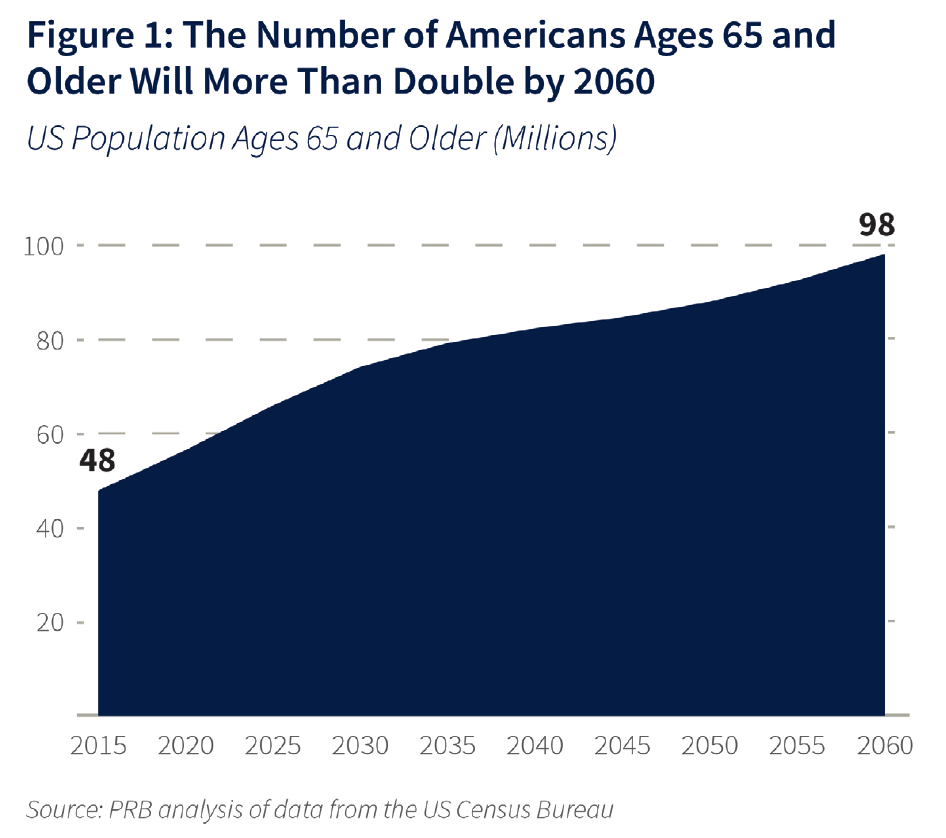

The United States is experiencing a demographic tidal wave. Baby Boomers are turning 65 in record numbers and that trend will accelerate in 2019 and beyond (Figure 1). [1] By 2029, when all of the baby boomers will be 65 years and older, more than 20 percent of the total U.S. population will be over the age of 65. By 2056, the population 65 years and over is projected to become larger than the population under 18 years. [2]Financing and insuring these aging boomers falls to Medicare.

Figure 1: The population of Americans 65 and older continues to accelerate.

“By 2029, when all of the baby boomers will be 65 years and older, more than 20 percent of the total U.S. population will be over the age of 65.”

As baby boomers pour into Medicare, they present increasing challenges and opportunities for healthcare. Longer life expectancies combined with multiple chronic conditions are associated with higher costs.

To meet these challenges, care models that reward value over volume will be vital to relieving stress on the healthcare system. One of those innovations is Medicare Advantage (MA) – a powerful tool that channels the spirit of the Institute of Healthcare Improvement’s “Triple Aim” goals of better care outcomes, lower costs and enhanced patient experience.

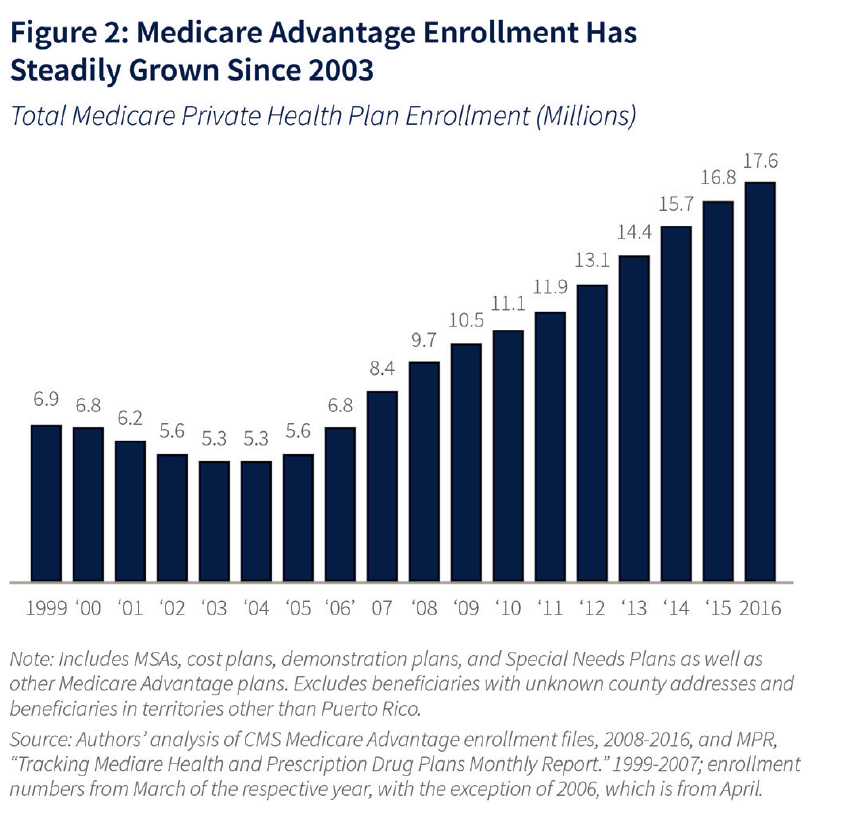

MA is becoming an increasingly popular option for seniors dissatisfied with traditional Medicare. Since 2004, the number of Medicare beneficiaries choosing privately-run MA plans has more than tripled, from 5.3 million to 17.6 million in 2016 (Figure 2).

Figure 2: Medicare Advantage enrollment has steadily grown since 2003

While MA began as a Republican idea, it now enjoys widespread bipartisan support and has emerged as Medicare’s most successful public-private partnership. The model encourages prevention and promotes better care. It offers consumers lower-cost plans with improved benefits over traditional Medicare.

Medicare Advantage paves the way for value-based care models that reward healthcare providers for delivering better healthcare at lower costs. By changing physician behavior to use resources more efficiently, MA may actually save the government money over time.

“Medicare Advantage paves the way for value-based care models that reward healthcare providers for delivering better healthcare at lower costs.”

As providers take more financial risk and payers share more surplus, MA delivers on the Triple Aim Plus One:

- Better Care: MA keeps beneficiaries healthier through comprehensive, coordinated care delivery.

- Lower Costs: MA reduces fee-for-service treatment activity.

- Enhanced Patient Experience: Beneficiaries are highly satisfied with MA. It delivers consistently high consumer satisfaction scores.

- Better Provider Experience: MA plans have the opportunity to innovate in care delivery, giving providers the incentives, tools and workflows that support value-based care delivery.

Research documents support these conclusions:

- A University of Southern California-led study showed that MA results in greater savings, more efficient quality of care and better patient outcomes for knee replacement and other common procedures than traditional Medicare. For example, 3.7 percent of joint replacement patients under MA were admitted to inpatient facilities post-surgery vs. 11 percent under traditional Medicare.[4]

- The Agency for Healthcare Research and Quality found that MA enrollees achieve equivalent or better health outcomes with lower hospital lengths of stay.[5]

- A Morning Consult poll showed that 80 percent of seniors are satisfied with the overall cost of MA plans, compared with 68 percent for traditional Medicare. For benefits, 86 percent are satisfied with MA versus 77 percent with traditional Medicare. See Figure 1 below for reference.[6]

- Rates of annual preventive care visits are 53 percent for MA HMO enrollees, compared to 33 percent in traditional Medicare.[7]

Voting with Their Feet

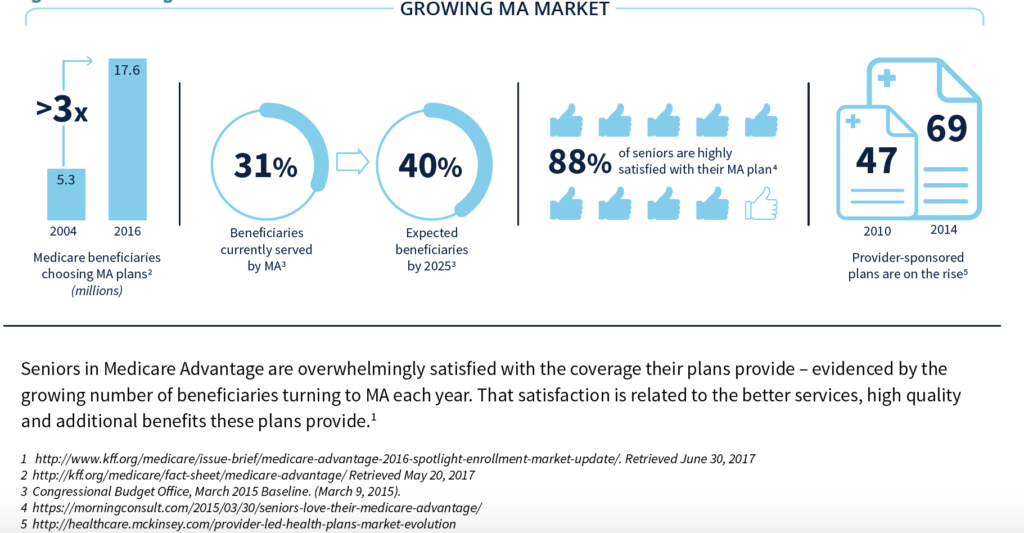

Enrollment in Medicare Advantage continues to outpace traditional Medicare enrollment. MA currently serves 31 percent of Medicare beneficiaries, and is projected to reach 40 percent by 2025.[8] Moreover, rather than starting out in traditional Medicare, America’s seniors increasingly select MA coverage in their first year of eligibility.

“MA currently serves 31 percent of Medicare beneficiaries, and is projected to reach 40 percent by 2025.”

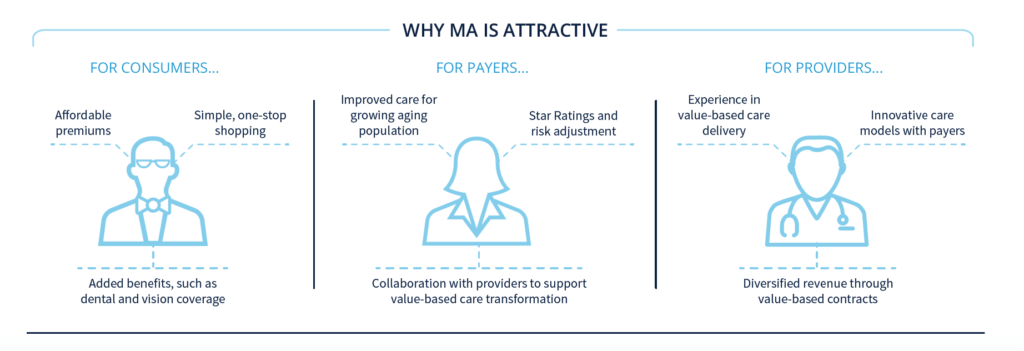

MA is achieving this enrollment growth because it works for providers and health plans, as well as for beneficiaries. The current number of MA plans is 2,034, 64% of which are HMO plans.[9]

As consumers move to MA plans in ever-larger numbers, health systems are responding. Provider-sponsored MA plans increased geometrically from 47 in 2010 to 69 in 2014.[10] Given the current healthcare landscape (e.g., the adoption of risk-bearing and other innovative payment models and the increased focus on reducing inpatient utilization rates), this trend will continue. Further, provider-sponsored MA plans are producing positive results, particularly in member satisfaction and other quality measures.[11] See Figure 3 below for reference.

Figure 3: Growing MA Market

The following three trends are fueling MA’s growth:

Consumers prefer it: Medicare Advantage is consumerism in action. MA plans are increasingly popular because they better meet seniors’ needs and desires for coverage.

MA plans typically offer additional benefits, including vision, dental and prescription drug coverage, not covered by traditional Medicare. More importantly, combining all of these benefits and programs into a single coverage plan makes it simpler for seniors to manage their care.

MA plans’ low member premiums and predictable costs are attractive to seniors living on fixed incomes. MA plans limit out-of-pocket costs which eliminates the variability of copayments and other costs of traditional Medicare.

It’s where the patients and money are: Aging demographics and increasing enrollment mean that an ever-higher percentage of the senior market is concentrated in the MA market. For example, the percentage of Minnesota Medicare beneficiaries enrolled in MA plans is 55 percent.

In order to remain competitive, providers and payers must participate in MA. As a consequence, health systems are launching independent Medicare Advantage plans and/or collaborating with existing MA plans to generate incremental revenues and gain care management experience with MA beneficiaries.

The future belongs to value-based care: Regulatory and market-based payment models are shifting more Americans into innovative population health management programs. These include direct-to-employer contracting, exchange-based health plans and Medicaid managed care programs, as well as Medicare Advantage plans. Enlightened health companies are developing value-based care capabilities now in anticipation of increased demand later.

Deconstructing Medicare Advantage

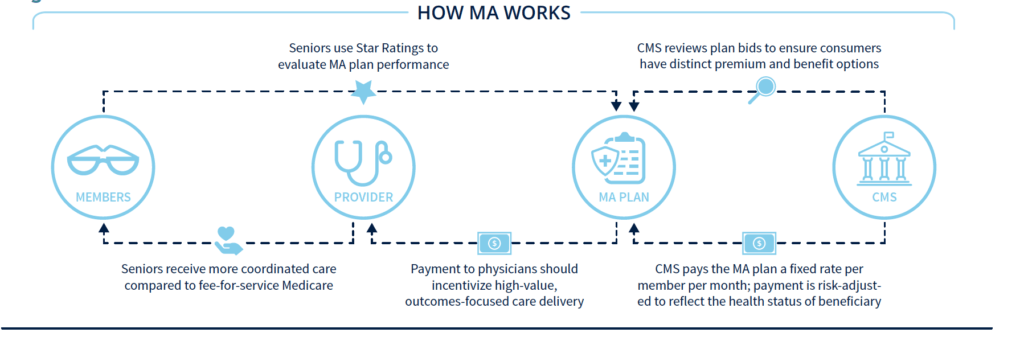

Medicare beneficiaries can choose to receive their benefits through private Medicare Advantage health plans as an alternative to traditional Medicare. MA plans compete to attract enrollees through plan design, marketing and quality ratings. To win, MA plans must address customer needs and comply with governmental regulations. Here’s how MA works:

Government Requirements Define Program: The Centers for Medicare and Medicaid (CMS) reviews plan bids to ensure they meet benefit and network adequacy requirements and meaningful differences standards (e.g., different out-of-pocket expenditure levels for drug purchases). This ensures plan options offer consumers a distinct choice of premium and benefit alternatives.

Under current law, health plans must dedicate 85 percent (or more) of premiums collected to direct care provision. The remaining 15 percent (or less) includes administrative costs and profits. Finally, MA plans that don’t meet CMS’ complex and evolving rules and regulations face the risk of stiff fines for non-compliance.

Comprehensive Fixed Payments Instead of Fee-for-Service: Medicare pays MA plans a fixed monthly amount per enrollee to provide health benefits. That payment amount reflects actuarial data, disease burden of the population, enrollment levels and local costs. In addition, Medicare makes a separate payment to plans for prescription drug benefits under Medicare Part D.

Member-level Risk Adjustment Supports Viability: Medicare risk-adjusts the base monthly payment to reflect the health status of enrolled beneficiaries. As a result, MA plans receive appropriately higher monthly payments for sicker enrollees. To receive the appropriate reimbursement for all enrollees, providers must accurately document clinical diagnoses and treatments. Risk adjustment is critical to ensuring that MA plans have adequate resources to provide consistent, high-quality care to their beneficiaries.

Transparent Star Ratings Drive Results: Medicare uses a Star rating system to measure the performance of MA plans and help consumers compare and select plans. The Star rating system categories include quality of care, customer service and clinical outcomes. The Star rating system is unique to Medicare Advantage and rewards high performers while weeding out poorer ones.[12]

Strong performance has financial and competitive benefits. Higher performing plans receive bonus payments from Medicare, which they must use to provide additional benefits to enrollees. Moreover, plans with five-star quality ratings can market to and enroll new members throughout the entire year, rather than only during the Annual Enrollment Period.

Innovative Care Delivery Models Encouraged: The need to manage the care needs of their enrollees effectively and efficiently encourages MA plans to construct innovative, value-based care delivery models. As referenced in Figure 4 bwlow, Plans and providers can benefit financially by providing coordinated, high-value care that promotes preventive care and early disease diagnosis, and delivers treatments in appropriate settings that are frequently lower cost than traditional Medicare. MA plans can engage providers in new reimbursement models that encourage them to use a wider array of approaches to achieve successful outcomes

Advantage Medicare Advantage

Medicare Advantage offers health plans and providers the chance to deliver high-value care profitably at lower costs through appropriate utilization. Highly-coordinated care, particularly for complex patients, reduces unnecessary ER visits and hospitalizations. As referenced to in Figure 5, properly applied, health plans can fund superior healthcare services and realize a margin on the required infrastructure for value-based care delivery. The program also yields more appropriate reimbursement, with revenues that more accurately reflect the actual health conditions of beneficiaries.

“Seniors are turning to Medicare Advantage plans in record numbers because consumer satisfaction with the program is high.”

Seniors are turning to Medicare Advantage plans in record numbers because consumer satisfaction with the program is high. A 2016 Morning Consult survey found that nearly 90 percent or more of MA members approve of their plans, preventive care coverage, MA benefits and provider choices.

As enrollment in Medicare Advantage grows, MA plans must recruit, train and support new providers in value-based care delivery. MA plans succeed when engaged physicians and aligned caregivers manage the healthcare needs of the population effectively. This requires strong clinical leadership, care coordination, outcomes-oriented (as opposed to volume-driven) compensation models, refined protocols, trusted customer relationships and outcomes measurement. It also requires an absolute commitment to evidence-based medical decision-making.

Figure 5: Why MA is Attractive

Before It’s Too Late

The national spotlight is shining on Medicare Advantage because it is transforming U.S. healthcare delivery. While not perfect, MA plans are making value-based care work, achieving better clinical outcomes and making customers happy.

In more service areas each year, Medicare Advantage enrollees are achieving sufficient critical mass to shift competitive dynamics. Providers must develop the capabilities to attract and serve MA customers or risk losing market relevance.

But successful health systems don’t necessarily make successful MA sponsors. Offering value-based insurance products is complex. It requires specialized expertise, infrastructure and information technology. It often requires a partner with skills and experience in launching MA plans

With unsustainable cost increases in the historic fee-for-service model, aging demographics, inconsistent care delivery, and mounting societal frustration, there has never been a greater need for health companies to develop value-based care capabilities. It’s U.S. healthcare’s biggest deficiency, but it’s also the industry’s most promising business opportunity.

Medicare Advantage provides the most logical path for health companies to develop sustainable value-based care business lines. Companies that master value-based care will be big winners in post-reform healthcare.

The race is on. Don’t be left behind.

In Part 3 of our series on payment reform, we’ll explain the mechanics of standing up and operating a Medicare Advantage plan. We’ll also discuss the capabilities needed to operate a plan and share some common challenges.

[2]U.S. Census Bureau. https://www.census.gov/prod/2014pubs/p25-1141.pdf. Retrieved July 11, 2017.

[3]Kaiser Family Foundation. http://kff.org/medicare/fact-sheet/medicare-advantage/. Retrieved May 20, 2017.

[4]Health Affairs. http://content.healthaffairs.org/content/36/1/91.full.pdf+html. Retrieved June 26, 2017.

[5]Agency for Healthcare Research and Quality Healthcare Cost and Utilization Project. “Statistical Brief # 198: Hospital Stays in Medicare Advantage Versus the Traditional Medicare Fee-for-Service Program, 2013.” December 2015. Retrieved June 26, 2017.

[6]Morning Consult. https://morningconsult.com/2015/03/30/seniors-love-their-medicare-advantage/. Retrieved June 26, 2017.

[7]Sukyung, Chung, Lesser, Lenard I., Lauderdale, Diane S. et. al. Medicare Annual Preventive Care Visits: Use Increased among Fee-for-Service Patients, But Many Do Not Participate. Health Affairs, 34, No. 1: 11-20. January 2015. Retrieved June 26, 2017.

[8]Congressional Budget Office, March 2015 Baseline. (March 9, 2015). Available at: https://www.cbo.gov/about/products/baseline-projections-selected-programs#10. Retrieved May 20, 2017.

[9]Kaiser Family Foundation. http://www.kff.org/report-section/medicare-advantage-plans-in-2017-issue-brief/. Retrieved June 21, 2017.

[10]McKinsey. http://healthcare.mckinsey.com/provider-led-health-plans-market-evolution. Retrieved May 20, 2017.

[11]Health Affairs. http://content.healthaffairs.org/content/36/3/539.full.pdf+html. Retrieved June 26, 2017.

[12]McKinsey & Company. http://healthcare.mckinsey.com/assessing-2017-medicare-advantage-star-ratings. Retrieved June 26, 2017.

CO-AUTHOR

Richard Jones

Richard Jones is the president and CEO of Essence Healthcare, one of the nation’s first accountable delivery systems and a consistently high-rated Medicare Advantage Prescription Drug (MAPD) health plan. In addition, he leads Lumeris Healthcare Outcomes, which offers full turnkey business process outsourcing and management services to support MA and commercial health plans.

Richard Jones is the president and CEO of Essence Healthcare, one of the nation’s first accountable delivery systems and a consistently high-rated Medicare Advantage Prescription Drug (MAPD) health plan. In addition, he leads Lumeris Healthcare Outcomes, which offers full turnkey business process outsourcing and management services to support MA and commercial health plans.

Richard is an experienced healthcare business executive, a certified public accountant and Founding President of Lumeris. He previously served as Chief Financial Officer of Essence Group Holdings Corporation (including Essence Healthcare), National President of UnitedHealthcare Medicare and Medicaid lines of business, President and Chief Executive Officer of Coventry Healthcare of the Midwest and Chief Financial Officer of Coventry Corporation.

About Lumeris

We provide strategic advising and technology to help providers and payers get back to the way healthcare should be—and share in the rewards. We guide health systems and providers through seamless transitions from volume to value, enabling them to deliver improved and more affordable care across populations—with better outcomes. And, we work collaboratively with payers to align contracts and engage physicians in programs that drive high-quality, cost-effective care with satisfied consumers—and engaged physicians.

An industry recognized leader, Lumeris was awarded 2017 Best in KLAS for value-based care managed services for helping clients deliver improved clinical and financial outcomes. This was the second year we received this distinguished award. For the past six years, Essence Healthcare, Lumeris’ premier client with more than 63,000 members in Missouri and Illinois, has received 4.5 to 5 Stars from the Centers for Medicare and Medicaid Services. We enjoy working with all of our clients, delivering these same results, and aligning our proven multi-payer, multi-population model with their value-based care vision.