September 26, 2023

Cain Bros House Calls Kickstarting Innovation (Part 2)

This is Part 2 of a series by Cain Brothers about the first-ever collaboration conference between health systems and private equity (PE) investment firms. Part 1 of this series addressed the conference’s who, what and where. This commentary will focus on the why. We will explore the underlying forces uniting health systems with private equity during this period of unprecedented industry disruption.

Why Health Systems and PE Need Each Other

On June 13 and 14, 2023, Cain Brothers hosted the first-ever collaboration conference between health systems and private equity (PE) investment firms. Timing, market dynamics and opportunity aligned. The conference was an over-the-moon success. Along with its sponsors, Cain Brothers will seek to expand the conference and align initiatives through the coming years.

On June 13 and 14, 2023, Cain Brothers hosted the first-ever collaboration conference between health systems and private equity (PE) investment firms. Timing, market dynamics and opportunity aligned. The conference was an over-the-moon success. Along with its sponsors, Cain Brothers will seek to expand the conference and align initiatives through the coming years.

Why Now? Healthcare is Stuck and Needs Solutions

As a society, the U.S. is spending ever-higher amounts of money while its population is getting sicker. A maldistribution of facilities and practitioners creates inequitable access to healthcare services in lower-income communities with the highest levels of chronic disease.

New competitors and business models along with unfavorable macro forces, including high inflation, aging demographics and deteriorating payer mixes, are fundamentally challenging health systems’ status quo business practices.

Over the last 50 years, healthcare funding has shifted dramatically away from individuals and toward commercial and governmental payers. In 1970, individual out-of-pocket spending represented 36.5% of total healthcare spending. Today, it is just over 10%.

Governments, particularly the federal government, have become healthcare’s largest payers, funding over 40% of healthcare’s projected $4.7 trillion expenditure in 2023. Individual patients often get lost in the massive payment shuffle between payers and providers.

Meanwhile, governments’ pockets are emptying. As a percentage of GDP, U.S. government debt obligations have grown from 55% in 2001 to 124% currently. With rising interest rates and the commensurate increase in debt service costs, as well as an aging population, there is little to suggest that new funding sources will emerge to fund expansive healthcare expenditures. Scarcity reigns where resources for healthcare providers were once plentiful.

As a consequence, the healthcare industry is entering a period of more fundamental economic limitations. Delaying transformation and expecting society to fund ongoing excess expenditure is not a sustainable long-term strategy. Current economic realities are forcing a dramatic reallocation of resources within the healthcare industry.

The healthcare industry will need to do more with less. Pleading poverty will fall on deaf ears. There will be winners and losers. The nation’s acute care footprint will shrink. For these reasons, health systems are experiencing unprecedented levels of financial distress. Indeed, parts of the system appear on the verge of collapse, particularly in medically underserved rural and urban communities.

More of the same approaches will yield more of the same dismal results. Waking up to this existential challenge, enlightened health systems have become more open to new business models and collaborative partnerships.

Necessity Stimulates Innovation

Two disruptive and value-based business models are on the verge of achieving critical mass. They are risk-bearing “payvider” companies (e.g. Kaiser, Oak Street Health and others) and consumer-friendly, digital-savvy delivery platforms (e.g. OneMedical and innumerable point-solution companies).

Value-based care providers and their investors have the scars and bruises to show for challenging entrenched business practices reliant on fee-for-service (FFS) business models and administrative services only (ASO) contracting. Incumbents have protected their privileged market position well through market leverage and outsized political influence.

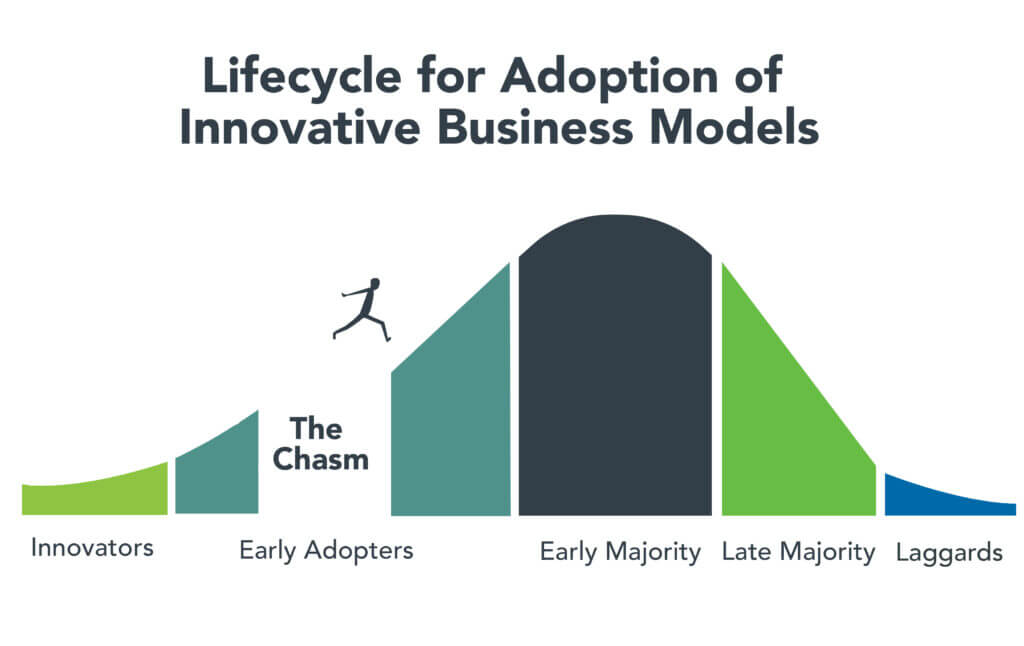

Despite market resistance, “payvider” and digital platform companies are emerging from the proverbial “innovators’ chasm.” More early adopters, including those health systems attending the Nashville conference, are embracing value-creating business models. The chart below illustrates the well-trodden path innovation takes to achieve market penetration.

Ironically, during this period of industry disruption, health systems understand they need to deliver greater value to customers to maintain market relevance. It will require great execution and overcoming legacy practices to develop business platforms that incorporate the following value-creating capabilities:

- Decentralized care delivery (to make care more accessible and lower cost).

- Root-cause treatment of chronic conditions.

- Integrated physical and mental healthcare services.

- Consistent, high-quality consumer experience.

- Coordinated service delivery.

- Standardized protocols that improve care quality and outcomes.

- A truly patient/customer-centric operating orientation.

It’s not what to do, it’s how to get it done that creates the vexing conundrum. Solutions require collaboration. Platform business models replete with strategic partnerships are emerging. Paraphrasing an African proverb, it’s going to take a village to fix healthcare. That’s why the moment for health systems and PE firms to collaborate is now.

PE to the Rescue?

Private equity has become the dominant investment channel for business growth across industries and nations. According to a recent McKinsey report, PE has more than $11.7 trillion in assets under management globally. This is a massive number that has grown steadily. PE changes markets. It turbocharges productivity. It is a relentless force for value creation.

By investing in a wide spectrum of asset classes, private equity has become a vital source of investment returns for pensions, endowments, sovereign wealth funds and insurance companies. Healthcare, given its size and inefficiencies, is a target-rich environment for PE investment and returns. This explains the PE’s growing interest in working with health systems to develop mutually beneficial, value-creating healthcare enterprises.

Despite reports to the contrary, PE firms must invest for the long term. Unlike the stock market, where investors can buy and sell a stock within a matter of seconds, PE firms do not have that luxury. To generate a return, they must acquire and grow businesses over a period of years to create suitable exit strategies.

Money talks. By definition, all buyers of new companies value their purchase more than the capital required for the acquisition. In making purchase decisions, buyers evaluate businesses’ past performance. They also assess how the new business will perform under their stewardship. PE or PE-backed acquirers also consider which future buyers will be most likely acquire the company after a five-plus year development period.

PE’s investment approach can align well with health systems looking to create sustainable long-term businesses tied to their brands and market positioning. PE firms buy and build companies that attract customers, employees and capital over the long term, far beyond their typical five- to seven-year ownership period. Health systems that partner with PE firms to develop companies are the logical acquirers of those companies if they succeed in the marketplace. In this way, a rising valuation creates value for both health systems and their PE partners.

It is important to note that not all PE are created the same. Like health systems, PE firms differ in size, market orientation, investment theses, experience and partner expectations. Given this inherent diversity, it takes time, effort and a shared commitment to value creation for health systems and PE firms to determine whether to become strategic partners. Not all of these partnerships will succeed, but some will succeed spectacularly.

For health system-PE partnerships to work, the principals must align on strategic objectives, governance, performance targets and reporting guidelines. Trust, honest communication and clear expectations are the key ingredients that enable these partnerships to overcome short-term hurdles on the road to long-term success.

Conclusion: Time to Slay Healthcare’s Dragons

Market corrections are hard. As a nation, the U.S. has invested too heavily in hospital-centric, disease-centric, volume-centric healthcare delivery. The result is a fragmented, high-cost system that fails both consumers and caregivers. The marketplace is working to reallocate resources away from failing business practices and into value-creating enterprises that deliver better care outcomes at lower costs with much less friction.

Progressive health systems and PE firms share the goal of creating better healthcare for more Americans. Cain Brothers is committed to advancing collaboration between health systems and PE-backed companies. In addition to the Nashville conference, the firm has combined its historically separate corporate and non-profit coverage groups to foster idea exchange, expand sector understanding and deliver higher value to clients.

The ability to connect and collaborate effectively with private equity to advance business models will differentiate winning health systems. In a consolidating industry, this differentiation is a prerequisite for sustaining competitiveness. It’s adapt or die time. Health systems that proactively embrace transformation will control their future destiny. Those that fail to do so will lose market relevance.

The future of healthcare is not a zero-sum equation. Markets evolve by creating more complex win-win arrangements that create value for customers. No industry requires restructuring more than healthcare. As a nation and an industry, we have the capacity to fix America’s broken healthcare system. The real question is whether we have the collective will, creativity and resourcefulness to power the transformation. We believe the answer to that question is yes.

Paraphrasing Rev. Theodore Parker, the economic arc of the marketplace is long but it bends toward value. Together, health systems and PE firms can power value-creation and transformation more effectively than either sector can do independently. Each needs the other to succeed. Slaying healthcare’s dragons will not be easy but it is doable. It’s going to take a village to fix healthcare.

Disclaimer: The information contained in this report was obtained from various sources, including third parties, that we believe to be reliable, but neither we nor such third parties guarantee its accuracy or completeness. Additional information is available upon request. The information and opinions contained in this report speak only as of the date of this report and are subject to change without notice.

This report has been prepared and circulated for general information only and presents the authors’ views of general market and economic conditions and specific industries and/or sectors. This report is not intended to and does not provide a recommendation with respect to any security. Cain Brothers, a division of KeyBanc Capital Markets (“Cain Brothers”), as well as any third-party information providers, expressly disclaim any and all liability in connection with any use of this report or the information contained therein. Any discussion of particular topics is not meant to be comprehensive and may be subject to change. This report does not take into account the financial position or particular needs or investment objectives of any individual or entity. The investment strategies, if any, discussed in this report may not be suitable for all investors. This report does not constitute an offer, or a solicitation of an offer to buy or sell any securities or other financial instruments, including any securities mentioned in this report. Nothing in this report constitutes or should be construed to be accounting, tax, investment or legal advice. Neither this report, nor any portions thereof, may be reproduced or redistributed by any person for any purpose without the written consent of Cain Brothers and, if applicable, the written consent of any third-party information provider.

“Cain Brothers, a division of KeyBanc Capital Markets” is a trade name of KeyBanc Capital Markets Inc. Member FINRA/SIPC.

KeyBanc Capital Markets Inc. and KeyBank National Association are separate but affiliated companies. Securities products and services are offered by KeyBanc Capital Markets Inc. and its licensed securities representatives. Banking products and services are offered by KeyBank National Association. Credit products are subject to credit approval. Copyright © 2023 KeyCorp.