April 3, 2017

Darwinian Outsourcing: Big Pharma Adapts to Market Realities

by Kristin Carey and David W. Johnson

Competitive markets drive innovations in business efficiency and strategy. Twenty-five years ago, Big Pharma companies did little outsourcing. Fortified by robust cash flows and high profit margins, they exercised near-total control over drug discovery, testing, approvals, manufacturing and distribution.

Today, an expansive outsourcing ecosystem enables Big Pharma to discover and bring new drugs to market more quickly and efficiently. This “delivery” innovation is under-reported. Mainstream media focuses on industry consolidation and surging prices in branded drugs, but gives little credit to pharma’s efforts to rationalize its costs by outsourcing.

Big Pharma has streamlined its execution costs in response to stark market realities. Blockbuster drugs have come off-patent. The pipeline of new drugs has narrowed. Most importantly, the cost of bringing new branded drugs to market has soared.

Necessity breeds innovation. Big Pharma loosened operating control and sought greater operating efficiencies. This enabled a massive pharma outsourcing sector to emerge over time, most notably with contract research organizations (“CROs”) and contract development and manufacturing organizations (“CDMOs”).

Broadly speaking, CROs do the underlying discovery and clinical development service work, and CDMOs make drug materials. This emergence of CROs and CDMOs has been good for Big Pharma, and REALLY good for investors who have enjoyed outsized returns from this outsourcing phenomenon.

Outsourcing: As Natural as Evolution

Outsourcing is as old as business and a logical consequence of industry maturation. As products commoditize, customers demand greater convenience, lower prices and a superior buying experience. Competition increases and profit margins tighten. Winning companies differentiate through continuous, value-based performance improvement.

Few companies in mature industries can remain competitive without help. Manufacturers focus on their core strengths and partner with companies that can assist in delivering better products at lower prices. Eager outsourcing companies develop expertise in aligned functions. Synergistic need creates beneficial strategic partnerships.

Outsourcing has been standard in the automotive, manufacturing and high-tech industries. Services range from back-office support to more strategic functions like logistics and manufacturing.

Apple learned the benefits of outsourcing the hard way. As a desktop computer manufacturer in the 1980s, Apple never relinquished control. It insourced product design, manufacturing, and marketing. This “control” mentality generated superior products for intensely loyal customers but also drove costs higher, restricted product sales and reduced profitability.

After near-bankruptcy, Apple repositioned its product offerings and market approach, particularly with the iPod, iPad and iPhone product lines.[1] Focusing on innovative design and marketing in-house, Apple outsourced manufacturing to Samsung Electronics and assembly to Foxconn.

That powerful marriage of elegant design, purpose-driven marketing innovation and outsourced manufacturing created a juggernaut. Apple devastated its competition and became the world’s most valuable company.

There is a downside to Apple’s success, however. Apple’s outsourcing partner, Samsung, emulated Apple’s in-house design approach to become the world’s number one smartphone producer.[2] Even Foxconn is not content to remain the world’s largest contract manufacturer of electronic devices. Instead, it recently purchased Sharp and expanded into brand-name production.[3]

Evolutionary competition can be complex, rapid and fierce. Successful companies can never rely on their past achievements. They must consistently improve.

Drivers of Big Pharma Outsourcing

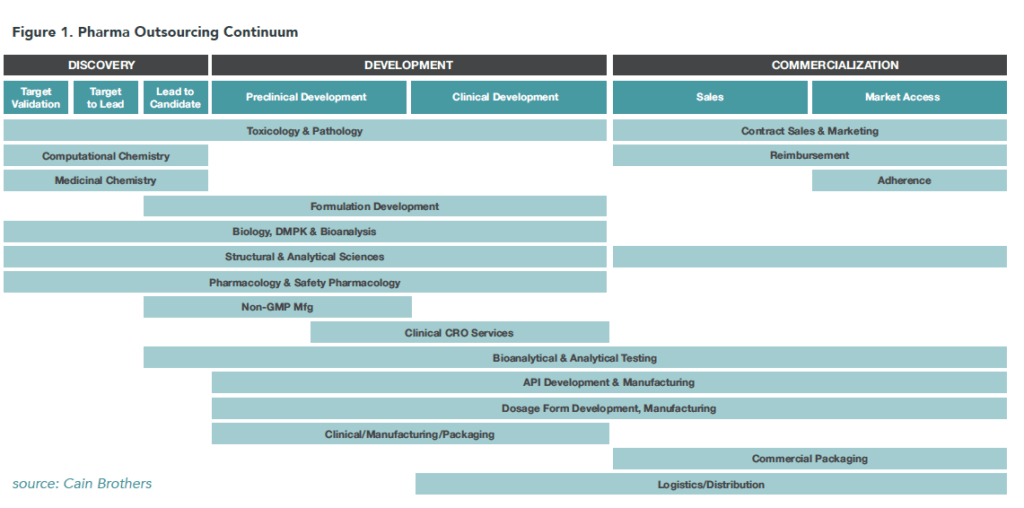

Big Pharma is navigating an increasingly regulated, costly, and complex product development continuum. The following chart depicts the complex and overlapping functions required to bring an efficacious drug to market.

Figure 1. Pharma Outsourcing Continuum

Drug discovery is risky and expensive. For every 10,000 to 15,000 compounds, only five advance to human testing and only one is ultimately approved for commercialization. As a result, pharmaceutical companies need to increase revenues and improve efficiency to fund drug development costs and sustain profitability.

Pharma has increased drug pricing to boost revenues, protect profits and fuel future R&D investment. In the past five years, average prices for branded drugs have nearly doubled.[4] Politicians, consumer groups and media critics have reacted negatively and vocally to sky-high prices on branded drugs, such as EpiPen[5], naloxone[6] and mebendazole.[7] Big Pharma cannot rely on raising prices alone to sustain profitability.

Like companies in other consolidating industries, Big Pharma companies have developed strategic partnerships to improve operating efficiency. These strategic partnerships help Big Pharma companies navigate the brutal path required to launch new drugs.

Evolutionary Growth in Outsourcing

Outsourcing works best when outsourcing companies align their operations with sponsoring companies’ targeted needs, market position and production characteristics. By definition, outsourced services must be both tailored to sponsors’ strategic, production and marketing needs as well as better, faster and cheaper than in-house alternatives.

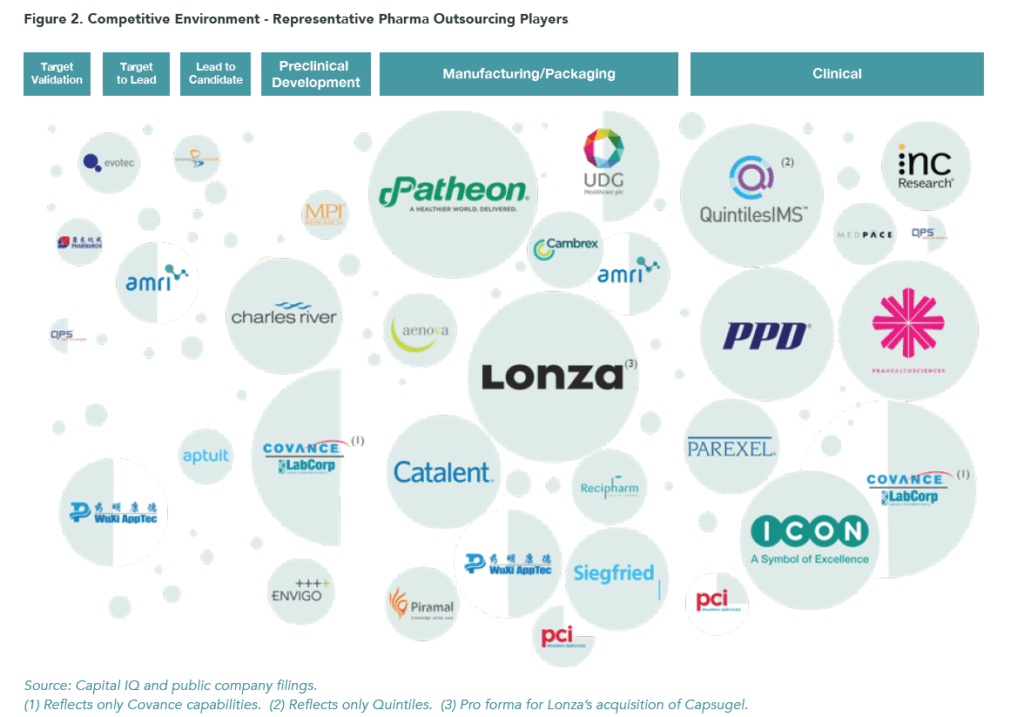

The pharma outsourcing landscape now includes a large universe of full service and niche CRO and CDMO players. We show examples of them in the following chart.

The market for these services is highly fragmented. Opportunities abound for niche providers to succeed even as smaller companies struggle to become full-service providers. Consolidation has been rapid, first among the CROs, and increasingly now across the CDMO market. Both sectors have robust trading multiples.

The best CRO partners offer expertise and scale. Only a few full-service CRO providers are large and sophisticated enough to manage multiple complex clinical trials across multiple geographies. They foster strong relationships with their Big Pharma sponsors and maintain complex IT systems.

The symbiosis of Big pharma and CROs is well established. CROs now conduct over 50% of the industry’s clinical trials.

After achieving widespread success in outsourcing clinical trials, Big Pharma increasingly is outsourcing its manufacturing and packaging functions as well. Meeting this need, CDMO companies now constitute about a third of total pharma manufacturing. Unlike CROs which were primarily “from-scratch-start-ups,” most CDMOs began as divisional carve-outs from Big Pharma or chemical companies.

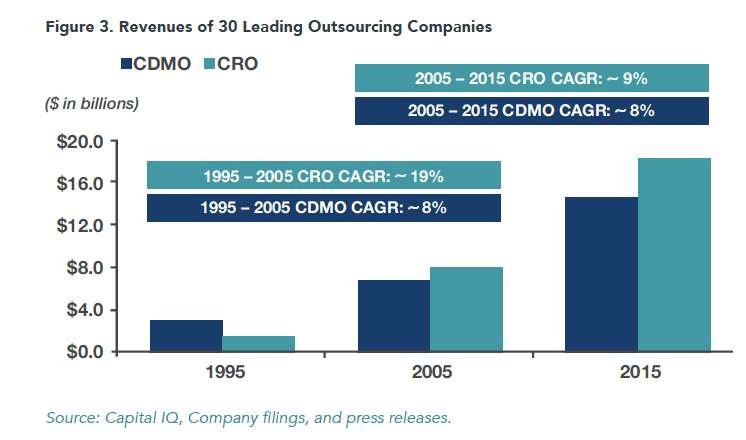

We have compiled financial evidence of the CRO/CDMO growth trends over time to demonstrate how important these outsourcing companies have become to the pharmaceutical industry. Our analysis tracks the revenues of 30 leading outsourcing companies over the last 20 years. These companies now account for roughly half of the $70 billion market for pharma outsourcing service companies.

It starts with the early 90s, when start-up CRO companies Quintiles, Parexel and PPD became hot IPOs. Competitors quickly hit the radar screen, including Covance (spun out of Corning), Charles River, and ICON.

In the 1990s, Lonza, Cambrex and Patheon (then Canadian) were the only CDMO businesses accessible to investors. Among others, Catalent, Piramal, PCI, AMRI, and Bushu became major CDMO players over time. The revenues of our group, shown below, depict the pace and scale of growth in the CRO/CDMO sector.

Viewed over this 20-year period, CRO and CDMO outsourcing has become an increasingly important feature of the biopharma marketplace. At 13x (from $1.4 billion in 1995 to $18.2 billion in 2015), CRO revenue growth is particularly striking. Between 1995 and 2005, our CROs grew 19% while the CDMOs grew only 8%. Between 2005 and 2015, that gap has narrowed as both CDMOs and CROs achieved high single-digit revenue growth.

Some of this growth has been fueled by emerging, mid-sized biopharma who rely entirely on out-of-house capabilities. But with a trajectory of this magnitude, clearly Big Pharma spend has shifted dramatically.

Historically, there were many more investment opportunities in CROs than CDMOs. That was then. More CDMO companies have gone public in the last few years. Investor interest in CDMOs is now surging, as the marketplace realizes that the factors (e.g. greater efficiency, reduced operational risk, enhanced innovation) that drove pharma to embrace CROs also apply to CDMOs.

Market dynamics will continue to pressure pharma to seek high quality outsourced services. CRO/CDMO services are vital to biopharma successfully navigating its future. The addressable market for their services is large, and still ripe for further penetration. If this is not enough to drive continued robust investor interest, the year-over-year growth and increasing margins of CROs and CDMOs will be. Their collective performance has been stellar.

Darwinian Logic

Charles Darwin once noted that it is not the strongest species that survive but the most responsive to change. In this evolutionary sense, it has been “adapt or die” time for pharma companies.

Pharmaceutical outsourcing is a logical and evolutionary response to improve operational performance and increase product value. The sweeping trends in outsourcing represent an elegant and synergistic pairing of outsourcing companies’ capabilities with Big Pharma’s development and operational needs.

The pace and complexity of change within the pharma sector is accelerating. Winning sponsors and outsourcers are adapting effectively to new marketplace realities by developing ever-more complex win-win relationships.

As the overall healthcare marketplace becomes more transparent, expect pharma outsourcing to continue its expansive growth as Big Pharma meets market demands for greater product value and accountability. In the pharmaceutical sector, as in all post-reform healthcare business sectors, Outcomes Matter, Customers Count and Value Rules.

[1] http://www.economist.com/blogs/dailychart/2011/08/apple-and-samsungs-symbiotic-relationship

[2] http://www.cio.com/article/2926435/innovation/how-apples-outsourcing-strategy-created-two-giant-competitors.html

[3] http://knowledge.wharton.upenn.edu/article/will-buying-sharp-help-foxconn-manufacture-global-brand/

[4] http://www.chicagotribune.com/business/ct-prescription-drug-prices-0316-biz-20160315-story.html

[5] http://www.cbsnews.com/news/epipen-price-hike-controversy-mylan-ceo-heather-bresch-speaks-out/

[6] http://www.attn.com/stories/14677/why-experts-are-worried-about-naloxone-pricing

[7] http://www.npr.org/sections/health-shots/2017/01/30/512400204/a-pinworm-medication-is-being-tested-as-a-potential-anti-cancer-drug

CO-AUTHOR

KRISTIN L. CAREY

Kristin Carey leads Cain Brothers’ Pharmaceutical Outsourcing and Specialty Pharmaceutical Advisory practices. Ms. Carey joined Cain Brothers in 2016, with 25 years of healthcare investment banking experience. Her career has been devoted to working for healthcare clients in the U.S. and abroad, executing transactions spanning M&A, public and private capital raising, and related advisory assignments.

Cain Brothers is a pre-eminent investment bank focused exclusively on healthcare. Our deep knowledge of the industry enables us to provide unique perspectives to our clients and is matched with the knowhow needed to efficiently execute the most complex transactions of all sizes. www.cainbrothers.com

The information contained in this report was obtained from various sources that we believe to be reliable, but we do not guarantee its accuracy or completeness. Additional information is available upon request. The information and opinions contained in this report speak only as of the date of this report and are subject to change without notice. This report has been prepared and circulated for general information only and presents the authors’ views of general market and economic conditions and specific industries and/or sectors. This report is not intended to and does not provide a recommendation with respect to any security. Any discussion of particular topics is not meant to be comprehensive and may be subject to change. This report does not take into account the financial position or particular needs or investment objectives of any individual or entity. The investment strategies, if any, discussed in this report may not be suitable for all investors. This report does not constitute an offer, or a solicitation of an offer to buy or sell any securities or other financial instruments, including any securities mentioned in this report. Nothing in this report constitutes or should be construed to be accounting, tax, investment or legal advice. Neither this report, nor any portions thereof, may be reproduced or redistributed by any person for any purpose without the written consent of Cain Brothers.

Cain Brothers is a member of SIPC. © 2016 Cain Brothers and Company, LLC